[ad_1]

UTXOracle is a straightforward Python script [Attention: direct download link] that takes good thing about a shocking truth concerning the Bitcoin blockchain – through parsing on-chain knowledge it’s imaginable to derive an approximate U.S. greenback value.

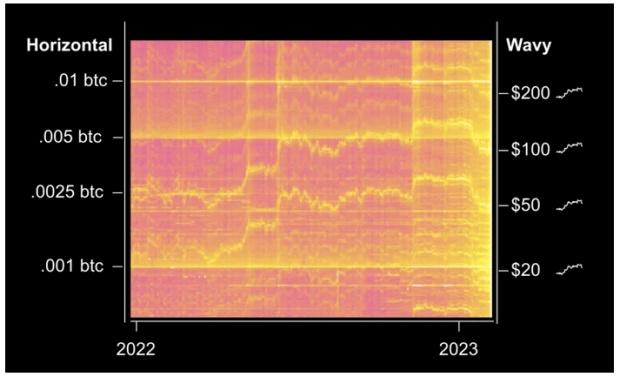

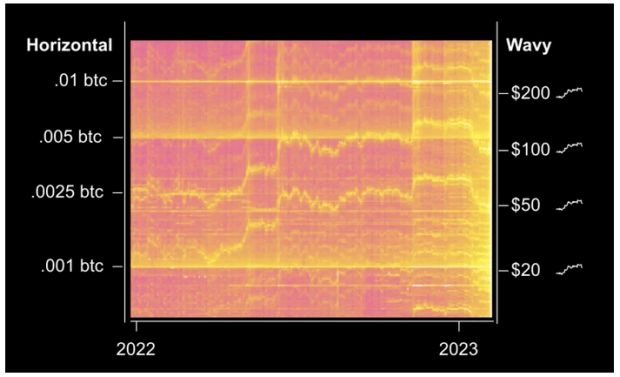

All of that is in line with the chart above. The strains at the graph constitute Bitcoin UTXOs of positive values.

For those who take a look at the left-hand aspect on the BTC denominations, you’ll be able to see that instantly strains fit up completely. The ones constitute the introduction of UTXOs in actual spherical BTC denominations. The wavy strains are UTXOs being created with spherical fiat denominations.

All that is to mention that an enormous share of Bitcoin transactions (~15%) create outputs with spherical denominations in fiat currencies, an difficult to understand knowledge quirk that permits instrument to make by-product assumptions concerning the financial task they constitute.

Via discovering the issues the place those wavy and instantly strains intersect, one can confirm a time limit when the fiat value of BTC was once a spherical quantity, and extrapolate to different closing dates.

However whilst this will likely sound extremely technical, and it’s, the fast result’s one thing helpful for each and every Bitcoiner, particularly those that need to harness its decentralization – with UTXOracle, customers who run a complete node not want to depend on third-party change value knowledge.

UTXOracle means that you can monitor the fiat value moderate only with on-chain knowledge, no longer best giving new talents to Bitcoiners, however to its product developers as neatly. In brief, it’s a large leap forward we think to present itself additional within the years forward.

Launched lately after some months of labor, I had an opportunity to invite writer and developer Steve Jeffress a couple of questions concerning the challenge. The next dialogue sheds additional mild at the instrument he launched, and what may lie forward:

SHINOBI: What gave you the perception into UTXO set quantity distributions having this courting with fiat value?

JEFFRESS: I have been rendering warmth maps of the UTXO set for like 8 years now. I have at all times recognized the USD value was once a transparent emergent assets of output patterns. I have recognized I may write this system for a number of years and in any case were given round to doing it.

SHINOBI: What are the constraints of the accuracy of UTXOracle?

JEFFRESS: At the moment, the bounds are $1,000 to $100,000 for the fee, and I have best examined it again to July twenty sixth, 2020. Additionally it is depending on other people proceeding to transact in spherical quantities of US bucks.

SHINOBI: What sort of use instances do you notice UTXOracle enabling?

JEFFRESS: I am excited to peer what other people get a hold of. I am glad if it encourages other people to do extra stuff with their very own node. Anything else that additional decentralizes nodes is a perfect certain factor IMO. I simply need to reinforce bitcoin.

SHINOBI: Can UTXOracle be gamed or manipulated?

JEFFRESS: Sure, for sure, on the other hand it will be pricey to govern. You may even be capable of estimate the cost of manipulation. Obviously if this was once used to settle contracts, the contracts would want to be some distance not up to some estimated price of manipulation

[One thing that Steve pointed out is the potential for delayed withdrawals to distort the accuracy of the model to a degree. For example, imagine you buy $50 of bitcoin on Coinbase and withdraw it. This type of behavior is a large driver of the data this model depends on. Imagine now if you buy $50 of bitcoin on Coinbase, but wait a week until you withdraw it. The price will be different than when you purchased it, meaning the on-chain output created will not accurately reflect the round amount in fiat it was when you purchased it.

This type of behavior could throw off the accuracy of the model, which is something to consider during a high fee environment when more people will adopt such behavior. The model could be adapted to account for this as long as larger value transfers that were economical still occurred in round fiat amounts on-chain. An algorithm could properly distinguish between those and lower value transactions that are throwing off the price model and weight the larger value transactions much higher than lower value transactions to account for the distortion.]

SHINOBI: May just this fashion be prolonged or made extra correct with different on-chain knowledge?

JEFFRESS: Most likely. although i feel other people must be mindful industry offs between simplicity, accuracy, complexity, and so on. As an example, I have written the code to maximise understandability over potency. I may import libraries to make it extra environment friendly, however I have selected to not.

For a deeper dive on UTXOracle, learn our characteristic information.

[ad_2]