[ad_1]

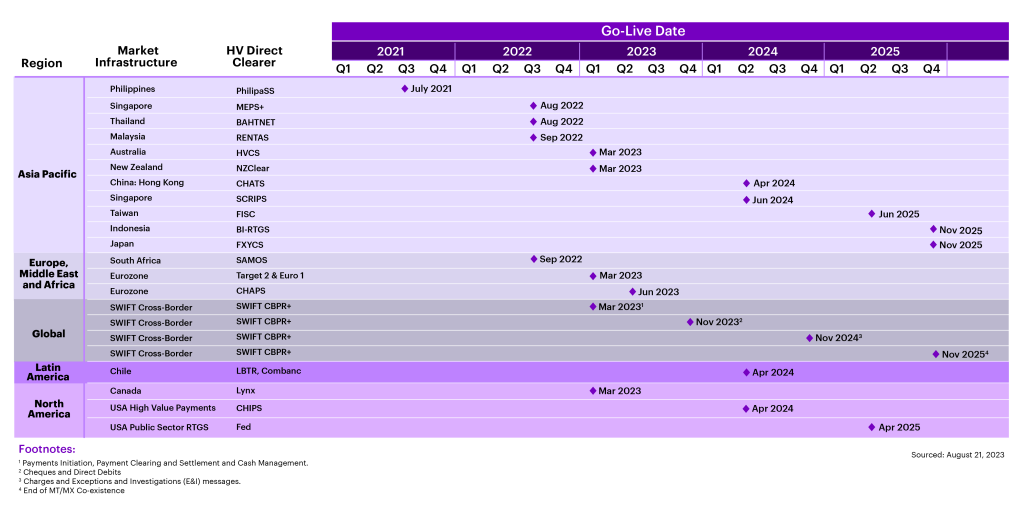

The years-long ISO 20022 adventure has accomplished a significant milestone this yr: it’s now getting used for cross-border bills. The brand new usual effectively introduced globally in March 2023 with SWIFT CBPR+, and at the Eu Marketplace Infrastructures of T2 (March 2023), Euro 1 (March 2023) and CHAPS RTGS (June 2023). Early information expose a wholesome stage of cost visitors within the new MX structure flowing via those marketplace infrastructures.

As an example, within the 3 months following the SWIFT CBPR+ implementation, a day-to-day moderate of 600,000 ISO 20022 messages had been despatched between greater than 1,000 senders and 5,600 receivers throughout 200 nations. CHAPS, some of the greatest high-value cost programs on the planet, processes a mean day-to-day price of £344bn (USD434bn) throughout 192,000 transactions the use of ISO 20022. For T2 we see a day-to-day moderate of 373,468 bills representing €1,877bn (USD2,028bn) in price, whilst Euro1 stories a day-to-day moderate quantity of 176,418 representing €190bn (USD205bn) in price.

For cross-border bills, the March 2023 implementation marks the start of a length of legacy and new structure co-existence.

“We needed to be an early adopter for move–border bills and made the daring selection emigrate all of our cost programs and all of our outbound CBPR+ visitors to ISO 20022. As of August 2023, J.P. Morgan constitutes ~50% the whole ISO 20022 cross–border cost message visitors on SWIFT.”

Colin Williams, World Clearing Transformation Lead at J.P. Morgan

In combination, those launches are a collective step for monetary products and services against a commonplace language throughout all monetary messages, each home and world. However the brand new usual’s true affect at the business and the sector remains to be to return.

That is true each in a normal sense and throughout the scope of cross-border bills. At this time, SWIFT CBPR+ makes use of ISO 20022-derived message codecs for bills initiation, bills clearing, agreement and money control. In November of this yr, the use circumstances will enlarge to incorporate exams and direct debit. In November 2024, new fees and E&I (enquires and investigations) will likely be added.

The worldwide monetary products and services business’s adventure to ISO 20022 adoption is easily underneath manner, with more than one marketplace infrastructures already are living in APAC and extra following, and North The usa getting ready for migration in H1 2024.

From compliance to price

Maximum banks presently are extra fascinated with attaining regulatory compliance with the usual than deriving price from it. Fresh Accenture analysis on industrial bills unearths that 60% of banks agree that maintaining with adjustments like ISO 20022 boosts their industrial bills innovation, whilst 29% stated it limits their talents on this regard.

When considered within the context of preliminary ISO20022 message structure adoption, this is sensible as a good portion of the price of ISO 20022 compliance will best be unlocked when key classes of wealthy information are exchanged throughout gamers within the bills ecosystem.

We think the aim code, felony entity identifier, remittance information, structured deal with and prolonged personality set classes to make the most important distinction, and their use will likely be mandated over the following couple of months and years. Taking the instance of latest CHAPS migration, goal codes might not be mandated till November 2024. Structured addresses, that are anticipated to noticeably enhance anti-fraud efforts, monetary crime control and straight-through processing, will likely be non-compulsory till overdue 2025.

The actual price of ISO 20022 for many banks and bills gamers has but to be discovered. However there may be just right explanation why to assume that proactive establishments will revel in a first-mover merit because the use and affect of the brand new usual unfold in the following couple of years.

View the ISO 20022 Enhanced Knowledge Adoption Regulatory Timeline [PDF]

A shopper pain-point and a possibility

To peer how a proactive angle to the usual can create alternatives, believe the placement from the standpoint of a industrial bills consumer. Accenture analysis discovered that 96% of business shoppers use ISO improve products and services nowadays (e.g., consumer checking out, MT/MX message comparability, truncation recommendation). However best 61% of banks globally supply the ones products and services, and consumer pleasure for the ones products and services sits at 48%.

The analysis additionally discovered a robust urge for food amongst industrial bills shoppers for value-added products and services which may be constructed at the enhanced information required through ISO 20022.

In different phrases, call for for products and services is excessive. Provide is proscribed and pleasure mediocre at absolute best. Relying on a financial institution’s standpoint, this case is both a possibility to consumer retention or a possibility to win new industry via awesome provider.

And the stakes will best upward thrust as extra company shoppers embark on their ISO 20022 migration trips.

The supply of wealthy information, ruled through regulatory necessities, will create new markets for brand spanking new and progressed banking services and products. Examples right here come with computerized receivables matching powered through remittance data; progressed personalization of services and products through inspecting transaction goal codes in actual time; and relief in cost screw ups because of the usage of structured addresses.

Key takeaways on the way forward for ISO 20022 and world bills

Whilst ISO 20022 didn’t release in 2023, it has nonetheless damaged new floor this yr. It’s now extensively used for cross-border bills in addition to in key home cost infrastructures in Asia and Europe. For instance, J.P. Morgan is now are living in 11 marketplace infrastructures with ISO 20022, with a number of extra in development throughout APAC, North The usa and LATAM.

ISO 20022 has already had an important affect, however its true price is related with the still-pending adoption of enhanced bills information. A financial institution’s skill to seize, procedure and alternate this knowledge will lend a hand it no longer best reach compliance however additionally snatch alternatives.

On this regard, notable alternatives are attached to industrial shoppers, who need help migrating to and the use of ISO 20022. Lots of them don’t seem to be extremely joyful with the provider they’re receiving nowadays, which represents doable enlargement for any financial institution with a proactive angle and powerful ISO 20022 improve.

Which may be the case for different spaces of ISO 20022’s affect on bills. It’s simple to concentrate on compliance presently, however the true merit and pleasure attached with ISO 20022, in our view, is its doable to free up price for banks, their shoppers, and markets as an entire.

We’d love to listen to about your personal enjoy with ISO 20022. Please succeed in out to Sulabh or Colin.

Thanks to Ather Rizvi and Ciáran Byrne for his or her beneficiant contributions to this put up.

For insights from J.P. Morgan’s contemporary enjoy of ISO 20022 migrations globally, please seek advice from ISO 20022: First 120 days are living

Accenture at Sibos – Accenture’s group will likely be in Toronto for Sibos, September 18-21, showcasing our newest pondering and inventions in bills, AI and cyber-security. Be informed extra about our complete program and request a gathering with considered one of our subject material mavens right here.

Disclaimer: This content material is supplied for normal data functions and isn’t supposed for use instead of session with our skilled advisors. This report would possibly discuss with marks owned through 1/3 events. All such third-party marks are the valuables in their respective house owners. No sponsorship, endorsement or approval of this content material through the house owners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

© 2023 JPMorgan Chase & Co. All rights reserved. The perspectives and reviews expressed herein are the ones of the writer and don’t essentially mirror the perspectives of J.P. Morgan, its associates, or its staff. The guidelines set forth herein has been bought or derived from assets believed to be dependable. Neither the writer nor J.P. Morgan makes any representations or warranties as to the guidelines’s accuracy or completeness. The guidelines contained herein has been equipped only for informational functions and does no longer represent an be offering, solicitation, recommendation or advice, to make any funding selections or acquire any monetary tools, and might not be construed as such. Talk over with jpmorgan.com/paymentsdisclosure for additional disclosures and disclaimers associated with this content material.

[ad_2]