[ad_1]

FOR THE COMPLETE MEDIUM- AND HEAVY-COMMERCIAL VEHICLE INDUSTRY

FORECAST

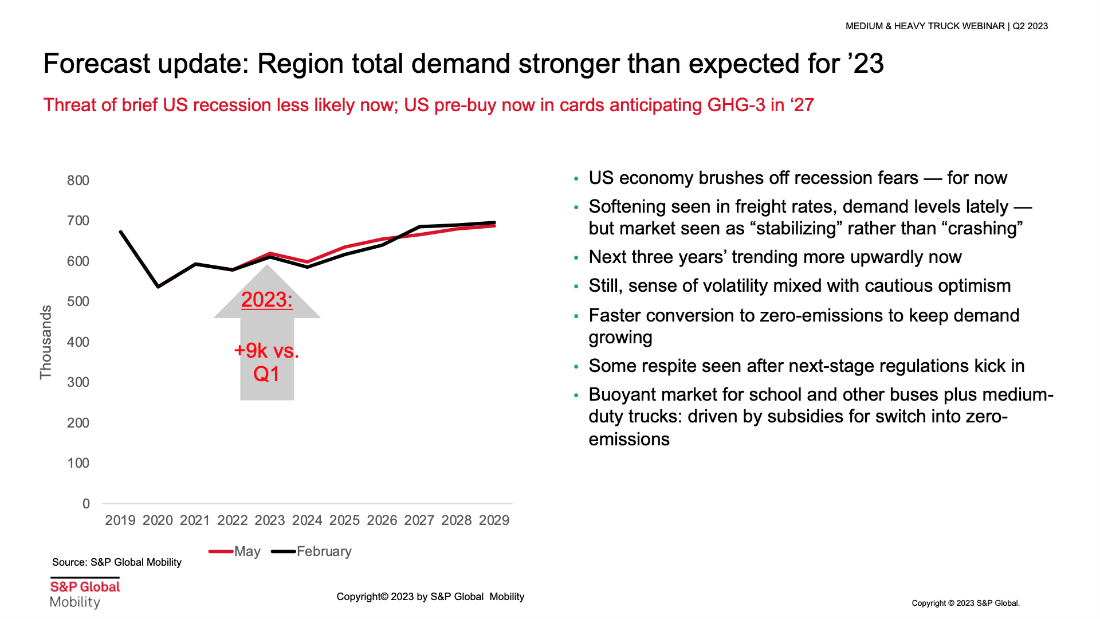

Call for is softening whilst manufacturing sustains in 2023,

slowing into ’24 – whereupon each rebound within the build-up to the

GHG-3 pre-buy wave.

Submit-pandemic marketplace corrections will flatten North American

call for and progress of Magnificence 5-8 business automobiles and buses within the

close to time period. Electrification will power accelerating progress as subsequent

tier of rules arrives in 2027.

The <span/>US financial system

seems to have skirted the fast recession in 2023, due to

stoic shopper spending in sturdy and nominal items, coupled with

the resurgence in products and services, trip, and eating places

– that have buoyed freight and truck task

regardless that nonetheless being constrained by way of provide chain problems after the

Covid-19 pandemic. A slowing-down is anticipated to be visual by way of the

fourth quarter, becoming a soft-growth 2024.

After a robust first part of 2023, there will have to be a average

relief in medium- and heavy-duty business automobile and bus

call for thru 2024, in keeping with the <span/>S&P World Mobility’s <span/>Q2 2023 forecast

replace. On the other hand, the up to date forecast maintains a extra sure

outlook for 2025 to 2026. when the truck marketplace gears up for the

subsequent degree of emissions rules. The 3rd tier of the 2027

greenhouse rules, mixed with the timing of the fleet

alternative cycle, will <span/>most likely gasoline a robust wave of pre-emptive

purchasing.

“The added value of the ones more difficult rules will power extra

acquire task in the course of the last decade,” stated Antti

Lindstrom, primary analyst for business automobile forecasting at

S&P World Mobility. Moreover, within the bus area, toughen

measures from the general public sector are using the conversion of

college buses and transit buses to zero-emission answers, including

to this constructive outlook.

CLICK HERE TO WATCH THIS AND OTHER WEBINARS

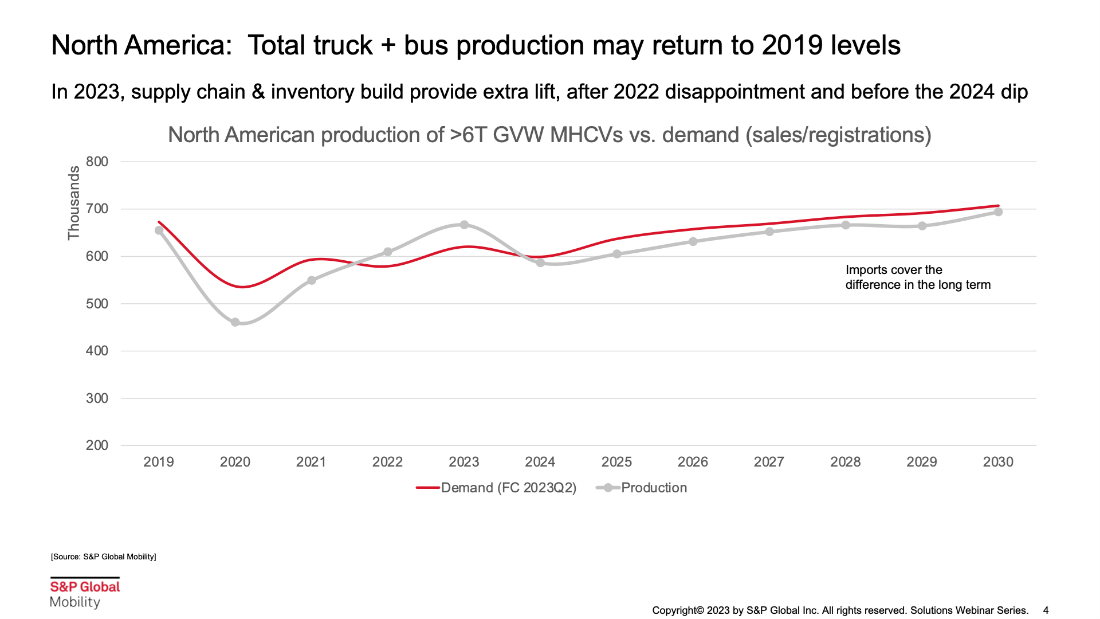

As momentum slows, call for is estimated to dip to a low of round

505,000 devices in 2024 (together with buses and motorhomes), with

projections indicating roughly 543,000 devices by way of 2025. Whilst

now not the principle driving force, the power transition within the trucking

sector beginning in California – plus a few dozen

different <span/>CARB states

with equivalent trajectories – is poised to toughen

quantity progress in 2023 and after. Along with anticipated

new-product updates, each established avid gamers and startup <span/>OEMs are proceeding to

introduce “cleaner” variations in their current truck fashions comparable to

the Freightliner eCascadia and Hino’s XL8 collection, to not point out

PACCAR’s Kenworth and Peterbilt <span/>BEV fashions that conform to zero-emissions

requirements.

There are a number of diversifications in observable marketplace tendencies throughout

other automobile categories:

- Magnificence 4 vans, that have been well-liked till the start of 2022,

were increasingly more taken as lighter-duty packages for

last-mile distribution right through the pandemic. Ford’s Magnificence 4

Econoline Cutaway fashion accounts for <span/>just about two-thirds of fashions on this

phase and would possibly see greater pageant emerging from the start-ups

getting into the fray. - Magnificence 5 automobiles, whilst going through provide chain problems, are

anticipated to peer an building up in call for following a post-pandemic

pause – for instance in public-sector purchasing. - Magnificence 6 vans have won consideration because of their gasoline

potency and suitability for plenty of business functions. On the other hand,

softening of the housing and building marketplace brought on a dip in

Magnificence 6 truck registrations. - Magnificence 7 vans were on a decline in recognition because of

their licensing necessities and better prices vs. Magnificence 6, in

addition to the hot choice of OEMs and consumers for vans

that bracket this phase.

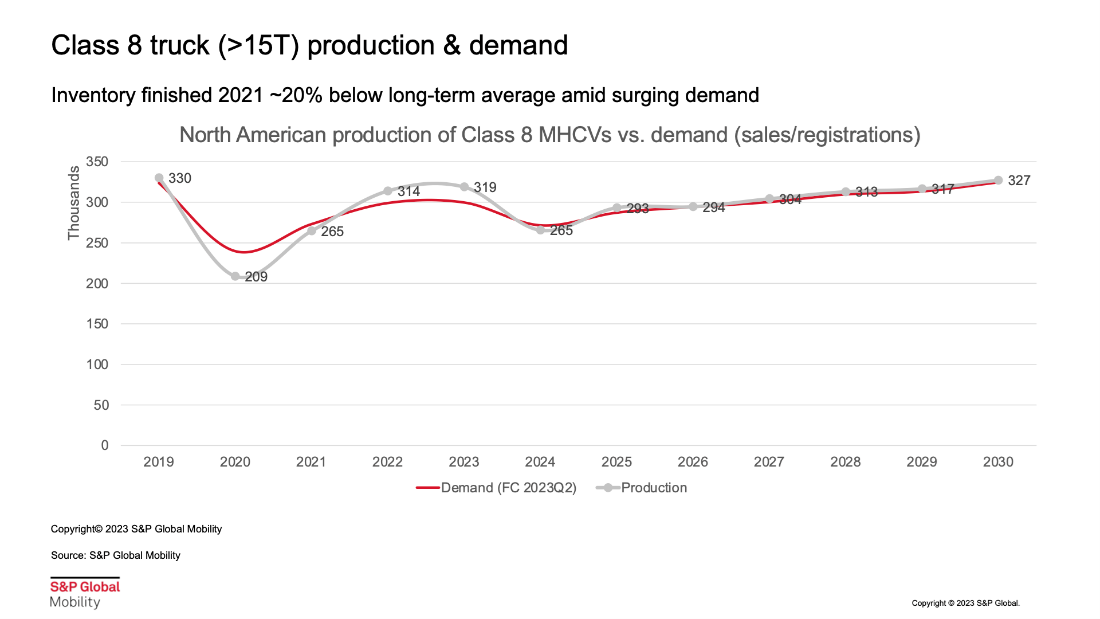

- After a more potent 2022 the place OEMs endured to concentrate on Magnificence 8

vans amid provide chain bottlenecks, we predict tractor-truck

registrations to stay flat this yr ahead of a dip in 2024, and a

modest upward trajectory alternatives up once more beginning in 2025. - Now not but recovered to pre-pandemic ranges, bus and motor house

call for is projected to climb considerably within the present yr and

ultimate at a equivalent degree in 2024, supported by way of a rebound in

college bus purchases. Enlargement is to renew in 2025, with motor houses

and different bus sorts anticipated to give you the further raise

then.

Without reference to weight magnificence, the extra stringent environmental

compliance would be the key driving force in call for and manufacturing of all

automobile sorts. Upcoming rules, particularly the proposed

greenhouse fuel emissions requirements by way of the Environmental Coverage

Company are forcing conventional OEMs to reassess their

production and funding methods and prompting a doubtlessly

fast shift from inner combustion engine (ICE) merchandise to

electrified automobiles.

Those rules, at the side of the ongoing push for extra

competitive decarbonization efforts by way of states like California with

its Complex Blank Fleet law, are performing as the important thing catalyst

within the transformation of powertrain applied sciences. On the other hand, the

transition to the adoption of hydrogen and gasoline mobile applied sciences

stays restricted by way of value, infrastructure, and availability problems.

This means battery-powered electrification because the go-to technique

will likely be driven additional into the midterm till the ones problems will also be

resolved – however the recharging community

for BEV vans, which is still constructed.

Disruptor manufacturers like Tesla and Nikola will boost up this

transition for his or her section and assist support the United States because the

area’s epicenter of manufacturing. As for the legacy manufacturers, regardless of

provide chain and exertions problems, their Magnificence 4-8 manufacturing charges for

the North The usa area reached or even moderately exceeded the

reasonable construct charges of 2019 by way of the tip of 2022. Whilst some

manufacturing goals are nonetheless now not being completed, inventories

proceed being rebuilt – atmosphere the degree for

doable progress later.

“Stock figures of Magnificence 4-7 vans – which

constitute about part the marketplace – stay beneath

long-term averages, which is one reason we expect manufacturing has

some upward doable,” stated Andrej Divis, government director of

world truck analysis at S&P World Mobility.

Total, provide call for continues to be sturdy, owing to the muted chance

of recession in comparison to the former two quarters, mixed with

unusually resilient shopper task. Manufacturing is anticipated to

maintain its surge within the quick time period, whilst ultimate constrained by way of

provide chain and exertions problems, ahead of levelling off or even

declining in 2024.

SUPPLY SHORTAGES AND NEW EVS AFFECT ’22 CV REGISTRATIONS

FOR THE COMPLETE MEDIUM- AND HEAVY-COMMERCIAL VEHICLE INDUSTRY

FORECAST

HYDROGEN: IN IT FOR THE LONG HAUL

TO WATCH THIS AND OTHER WEBINARS

CAN BRAZIL’S COMMERCIAL TRUCK FLEET TURN ELECTRIC?

COMMERCIAL VEHICLE INSIGHTS AND INTELLIGENCE

This text used to be revealed by way of S&P World Mobility and now not by way of S&P World Scores, which is a one by one controlled department of S&P World.

[ad_2]