[ad_1]

With sky-high assets costs, loan charges the very best they’ve been in a long time, and a great deal of financial uncertainty, the housing marketplace appeared poised for a correction in 2023. However that hasn’t took place. As a substitute, assets costs have remained flat for many of the yr and, by way of some accounts, are in reality expanding.

How is that this conceivable? In spite of the entire headwinds going through the residential housing marketplace, how have costs remained so resilient?

How the Economics Paintings

Let’s take a look at the economics to grasp. Assets costs, like any costs in a marketplace financial system, are dictated by way of provide and insist. In the event you’ve by no means taken an economics magnificence or are a couple of years got rid of out of your final one, let’s refresh.

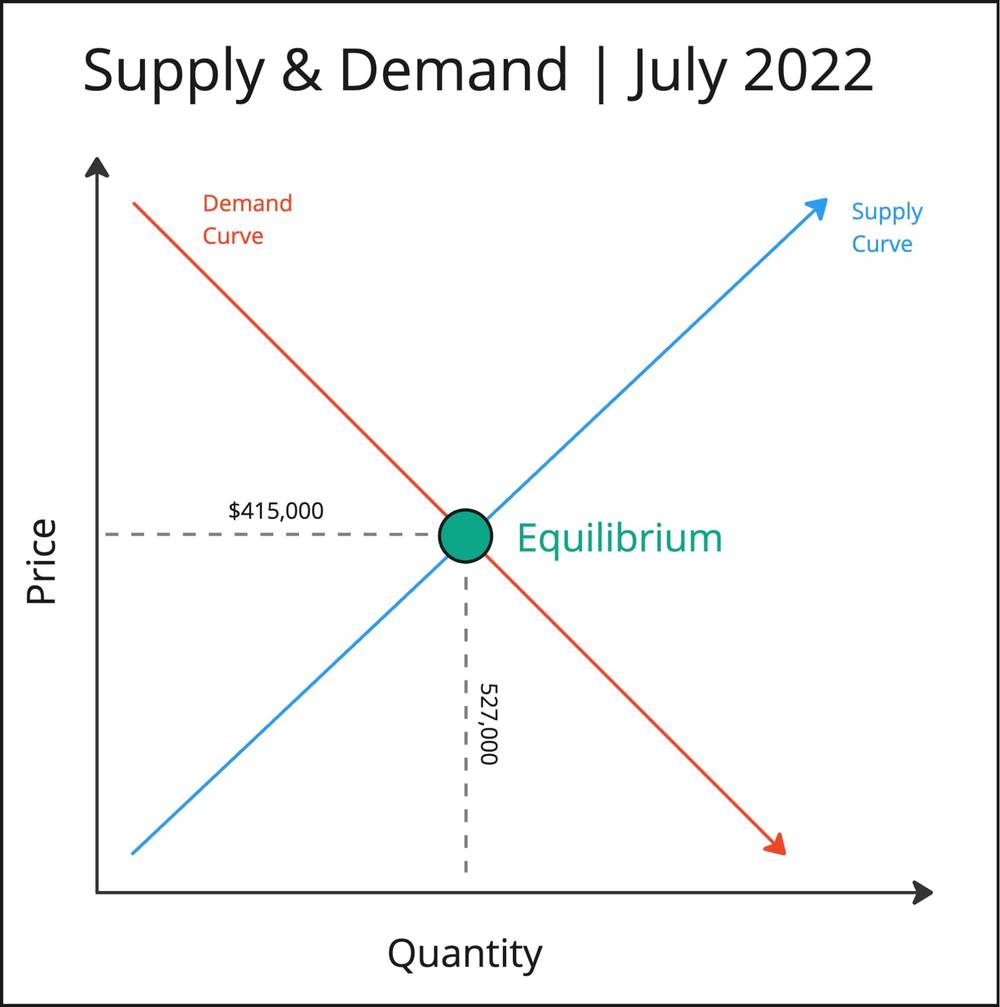

Provide is largely the volume of stuff on the market. Within the housing marketplace, we name provide stock. Call for is the quantity of people that wish to purchase the stuff that’s on the market. Within the housing marketplace, that is buyers and homebuyers. Provide and insist each perform on a spectrum (referred to as a curve in economics) and the place the 2 curves meet is referred to as equilibrium.

Equilibrium is largely what the marketplace can toughen in the case of worth and general amount. It’s the place provide and insist to find stability at a given cut-off date.

For instance, in keeping with provide and insist on the time, the equilibrium within the housing marketplace in July 2022 used to be 527,000 properties bought at a mean worth of $415,000. Given the various variables that affect provide and insist, that is the selection of gross sales and the common sale worth the marketplace may toughen.

However, in fact, provide and insist aren’t static. The curves shift and alter over the years in keeping with the fee and amount of transactions out there. For instance, if provide will increase (there’s extra stuff to shop for) and insist remains consistent, there can be extra gross sales (amount) at a cheaper price.

The place We Are Now

Since final summer season, provide and insist have modified so much. Because of excessive inflation, the Federal Reserve has raised the federal finances charge, and loan charges have spiked correspondingly. This, as predicted, has reduced call for.

As the fundamentals of provide and insist let us know, when issues get costlier, call for is going down. Having a look on the Loan Bankers Affiliation’s Acquire Index, you’ll see that call for for acquire mortgages (versus refinances) has cratered even past the place it used to be within the fallout of the monetary disaster.

This used to be a quite evident end result of emerging rates of interest and why such a lot of forecasters known as for a decline in house costs in 2023.

As you’ll see within the chart, when call for drops (as proven within the shift from D1 to D2) and provide remains consistent, the equilibrium shifts downward. The amount (selection of house gross sales) falls, as does the common worth of transactions.

However as I stated, this concept of costs declining is based on provide (within the housing marketplace referred to as stock) staying consistent. That’s not what’s took place. As a substitute, stock has fallen from 2022 ranges, in large part because of the lock-in impact.

In July 2022, stock used to be round 1.24 million. In July 2023, stock used to be about 980,000.

What occurs when provide and insist drop proportionally on the identical time? Costs stay slightly flat, and amount (gross sales quantity) decreases. Equilibrium nonetheless shifts, nevertheless it declines best in the case of amount, no longer in the case of worth.

And that is precisely what we’re seeing. Throughout the summer season of 2023, house costs have remained slightly flat yr over yr, but gross sales quantity has dropped 15%.

After all, no person is aware of what’s going to occur someday. Provide and insist are all the time converting. However if you wish to perceive what has took place up to now in 2023 and why the marketplace hasn’t dropped, glance no additional. Upper costs have pulled call for out of the marketplace, however provide has dropped quite proportionately, riding down gross sales quantity however preserving costs secure.

What Must We Be expecting For 2024?

As we glance to 2024, the query turns into: What’s going to transfer provide and insist? How will equilibrium be impacted by way of the various unsure marketplace forces at play?

My feeling, as of now, is that provide isn’t going to transport a lot. I believe the lock-in impact is actual, and foreclosure are nonetheless under ancient averages. New development is forged, however because of constructed instances, it received’t make a dent in stock any time quickly. As such, I don’t suppose we’ll see a significant build up in new listings till loan charges manner 6%.

Call for, personally, is far much less sure. If rates of interest keep the place they’re as of this writing (round 7.5%) and even cross up, I be expecting call for to go to pot. A big smash within the exertions marketplace and lengthening unemployment may additionally decrease call for. If both (or each) of the ones issues occur, I be expecting costs to come back down a bit of (however no longer so much as a result of provide is strong!).

However, if loan charges decline and the industrial image will get much less cloudy, call for may really well build up in 2024, which might nearly unquestionably ship costs upward.

Which of those eventualities will spread? It’s laborious to mention. Generally, I make predictions for the approaching yr at first of October, however I’m going to present myself a couple of additional months as a result of creating a prediction this yr could be very daunting. As such, I’m going to attend and notice how inflation and exertions marketplace knowledge, in addition to Fed coverage, alternate within the coming months.

What do you are expecting will transfer provide and insist in 2024? Percentage your ideas within the feedback.

I’d additionally love your comments in this article. I’ve been short of to put in writing a extra technical-style article like this one for months, however I’ve been hesitant as a result of I wasn’t certain how other folks would react. Please let me know what you suppose—just right, dangerous, or unsightly. If there’s a manner I may provide an explanation for those ideas higher or stuff you have been puzzled about, please let me know.

In a position to reach actual property making an investment? Create a loose BiggerPockets account to be told about funding methods; ask questions and get solutions from our group of +2 million individuals; connect to investor-friendly brokers; and so a lot more.

Notice By means of BiggerPockets: Those are evaluations written by way of the creator and don’t essentially constitute the evaluations of BiggerPockets.

[ad_2]