[ad_1]

Inside the insurance coverage trade, we needless to say to be able to stay related and retain marketplace proportion we wish to be agile, cutting edge and undertake new applied sciences. From a technical standpoint, which means insurers want as a way to adapt their endeavor structure briefly and sustainably to be able to reinvent themselves and develop. Then again, in an trade rife with legacy structure, programs modernization is a urgent downside. How can insurers design destiny programs that each uphold the legacy they have got created and combine into the fashionable international?

Accenture is operating along its insurance coverage shoppers to deal with this problem. The result’s a brand new frontier in how technological infrastructure is constructed.

Insurance coverage structure design is replacing

We wish to trade how insurance coverage structure is designed for better agility and enlargement. This isn’t confined to our trade by myself. Throughout all industries, there’s a seismic shift from rigid, monolithic structure to modular apps that may adapt to trade trade by way of assembling, reassembling, and increasing. This assists organizations in preserving tempo with replacing buyer calls for, provide chain disruptions, financial uncertainty, and the speedy tempo of technological development.

Insurance coverage is an trade wealthy with knowledge but frequently laden by way of legacy era. New, adaptable answers will set main insurers aside. In step with Gartner, by way of 2023 organizations that experience followed an clever composable method will outpace festival by way of 80% within the pace of latest function implementation.

The composable endeavor in insurance coverage – what’s new

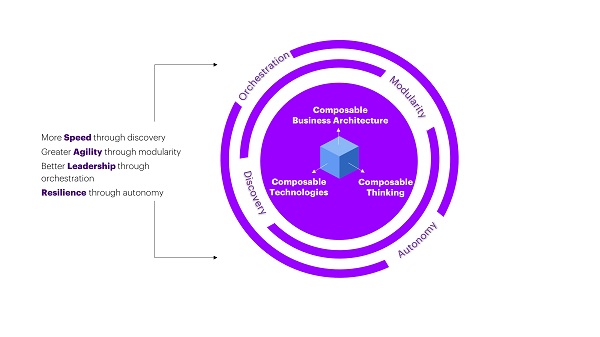

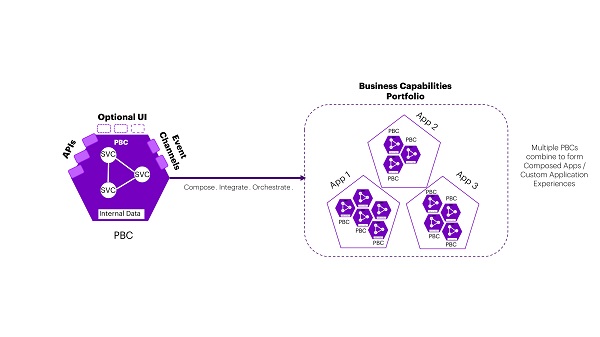

A composable endeavor may also be explained as a company that delivers trade results successfully and adapts to the tempo of commercial trade. The virtual structure that allows the composable endeavor is constructed on a robust Utility Program Interface (API)-centric mindset, with trade purposes which are encapsulated in interchangeable parts. In composable structure, APIs assist to reinforce pliability and ecosystem oversight. This is helping the organizations to democratize the trade procedure and change into a extremely scalable virtual trade. For insurers, this method holds a lot of probabilities to simplify and scale their virtual operations. Packaged trade Functions (PBCs) – encapsulated device parts that constitute a well-defined trade capacity – may also be created to be simply recognizable to trade customers. Whilst the idea that of composable structure has been round for a couple of years, we at the moment are harnessing the ability of PBCs to create in point of fact replicable and scalable infrastructure answers.

How insurers can get advantages

By way of leveraging the chances of a composable endeavor and PBCs, insurers can scale with pace and agility. to create a robust basis for a composable endeavor:

- Construct Modular Industry Functions: If insurers wish to construct a scalable composable structure, they wish to have a collection of self reliant trade functions that may be plugged in combination to execute a trade procedure uniquely that brings a aggressive benefit. Those modular trade functions will have to be capable of be controlled independently and progressed whilst collaborating in a bigger trade type.

- Create Modular Era Functions: To toughen the modular trade functions, insurers wish to construct modular era functions that may be simply built-in to allow smarter trade fashions. Those wish to be self reliant, controlled and modular to be able to be mixed by means of a typical interface to toughen the desired trade want.

In abstract, taking a composable option to technological structure in insurance coverage has game-changing possible. It permits insurers to future-proof technique via design, center of attention on proactive advent and notice greater pace in function implementation. In our subsequent weblog publish on this sequence, I can proportion sensible examples of composable structure in an insurance coverage claims context.

Get the most recent insurance coverage trade insights, information, and analysis delivered immediately in your inbox.

Disclaimer: This content material is supplied for basic knowledge functions and isn’t meant for use rather than session with our skilled advisors.

Disclaimer: This record refers to marks owned by way of 1/3 events. All such third-party marks are the valuables in their respective house owners. No sponsorship, endorsement or approval of this content material by way of the house owners of such marks is meant, expressed or implied.

[ad_2]