[ad_1]

General, simply 2% of house owners with a loan (1.1 million properties) had destructive fairness as of the second one quarter. On a year-over-year foundation, destructive fairness rose via 4% to at least one.1 million properties, or 1.9% of all mortgaged houses.

For the reason that marketplace’s top in the second one quarter of 2022, householders’ fairness declined via a complete of $287.6 billion, a lack of 1.7% 12 months over 12 months.

“Whilst U.S. house fairness is now less than its top in the second one quarter of 2022, homeowners are in a greater place than they have been six months in the past, when costs bottomed out,” stated Selma Hepp, leader economist for CoreLogic.

“The 5% general building up in house costs since February implies that the typical U.S. home-owner has received nearly $14,000 in comparison with the former quarter, an important development for debtors who purchased when costs peaked within the spring of 2022.”

Hepp additionally pointed to components equivalent to down bills and herbal screw ups, which will actually have a destructive have an effect on on house fairness.

Nationwide home-owner fairness

In the second one quarter of 2023, the typical U.S. home-owner misplaced roughly $8,300 in fairness right through the previous 12 months, the file confirmed.

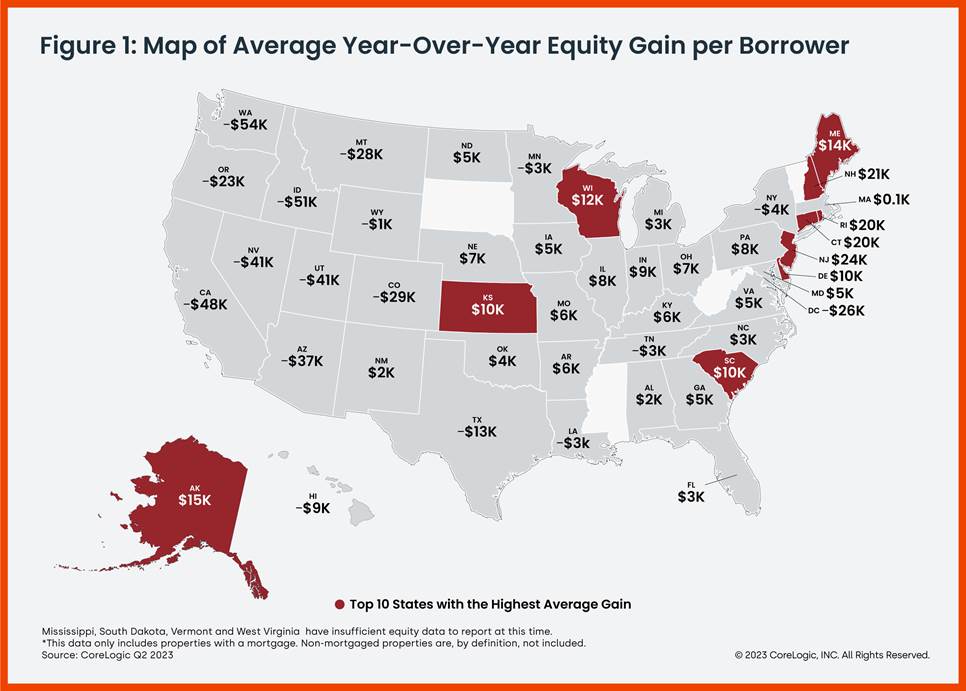

New Jersey, New Hampshire, Connecticut and Rhode Island skilled the biggest year-over-year reasonable fairness good points, all at $20,000 or extra. In the meantime, 16 states and one district posted annual fairness losses: Arizona, California, Colorado, Hawaii, Idaho, Louisiana, Minnesota, Montana, Nevada, New York, Oregon, Tennessee, Texas, Utah, Washington, Wyoming and Washington, D.C.

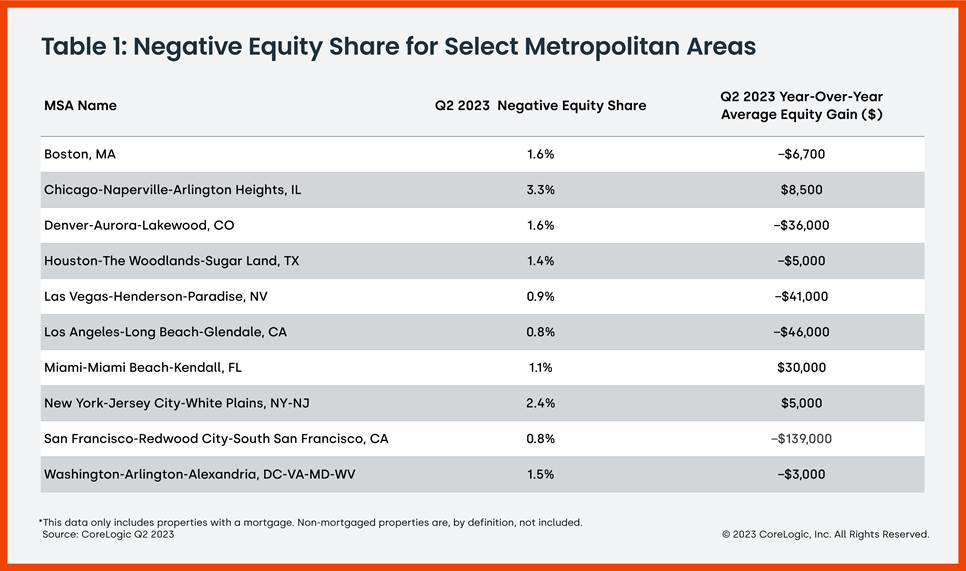

CoreLogic additionally supplies home-owner fairness information on the metropolitan degree. The knowledge supplier famous that 0.8% of houses with a loan within the San Francisco and Los Angeles metro spaces had destructive fairness in the second one quarter. In San Francisco, the typical fairness loss year-over-year was once $139,000. It was once destructive $46,000 in Los Angeles.

Quarter over quarter, U.S. householders with mortgages received on reasonable $13,900, a collective building up of $806 billion (5.2% achieve) in house fairness.

Debtors within the West persisted to submit the biggest year-over-year fairness losses. On the other hand, the file discovered that householders in states like Hawaii, California and Washington “nonetheless have essentially the most gathered fairness because of the tempo of appreciation during the last decade.”

[ad_2]