[ad_1]

Paying all coins for a space is without doubt one of the absolute best tactics to overcome out your festival and get a greater deal.

With all coins, you should not have to publish an be offering with a financing contingency, which dealers dislike. In consequence, you building up your probabilities of successful a bidding warfare at an inexpensive value. Additional, with all coins, you could possibly get a bigger cut price.

I paid all coins for a house in 2019 and used to be in a position to save lots of about $100,000 – $150,000 off the marketplace acquire value. Being a neighbor, going twin company, writing a cast love letter, and having a quick shut had been additionally necessary variables.

Even if paying all coins makes the home-buying procedure more straightforward, there are nonetheless some downsides to pay attention to. Let’s speak about!

The Downsides Of Paying All Money For A Area

The older I have gotten and the upper rates of interest cross, the fewer motivated I’m to tackle a loan to shop for a space.

Getting pre-approved for a loan is a bulky procedure that calls for a large number of forms and an amazing quantity of persistence. There could also be the loan utility charge, which might simply run between $2,000 – $10,000. Therefore, if I am able to pay all coins for a space, it’s my choice.

On the other hand, there are downsides to the entirety. Those are the principle ones in case you are taking into account paying all coins for a house.

1) Capital positive factors tax

One approach to pay all coins for a house is to boost budget by means of promoting different investments. The longer you personal your investments, in most cases, the better the positive factors. The hot button is to check out and promote your investments in some way that fits sufficient losers with winners to reduce your capital positive factors tax.

However after a protracted bull marketplace, paying capital positive factors taxes on asset gross sales may well be an inevitability. Chances are you’ll sooner or later be beaten with too many winners.

The one approach to keep away from capital positive factors tax is that if you’ll be able to make the most of uninvested coins to shop for a house. It’s possible you’ll even scale back your tax legal responsibility as a result of you’ll be able to now not need to pay federal and state source of revenue taxes at the source of revenue earned by means of your coins.

However until you by no means plan to promote your investments, you’re going to sooner or later need to pay capital positive factors tax. It is excellent to promote shares sometimes whilst you’ve earned sufficient to shop for no matter you need. Differently, what is the level of making an investment within the first position?

2) It’s possible you’ll fail to notice additional positive factors

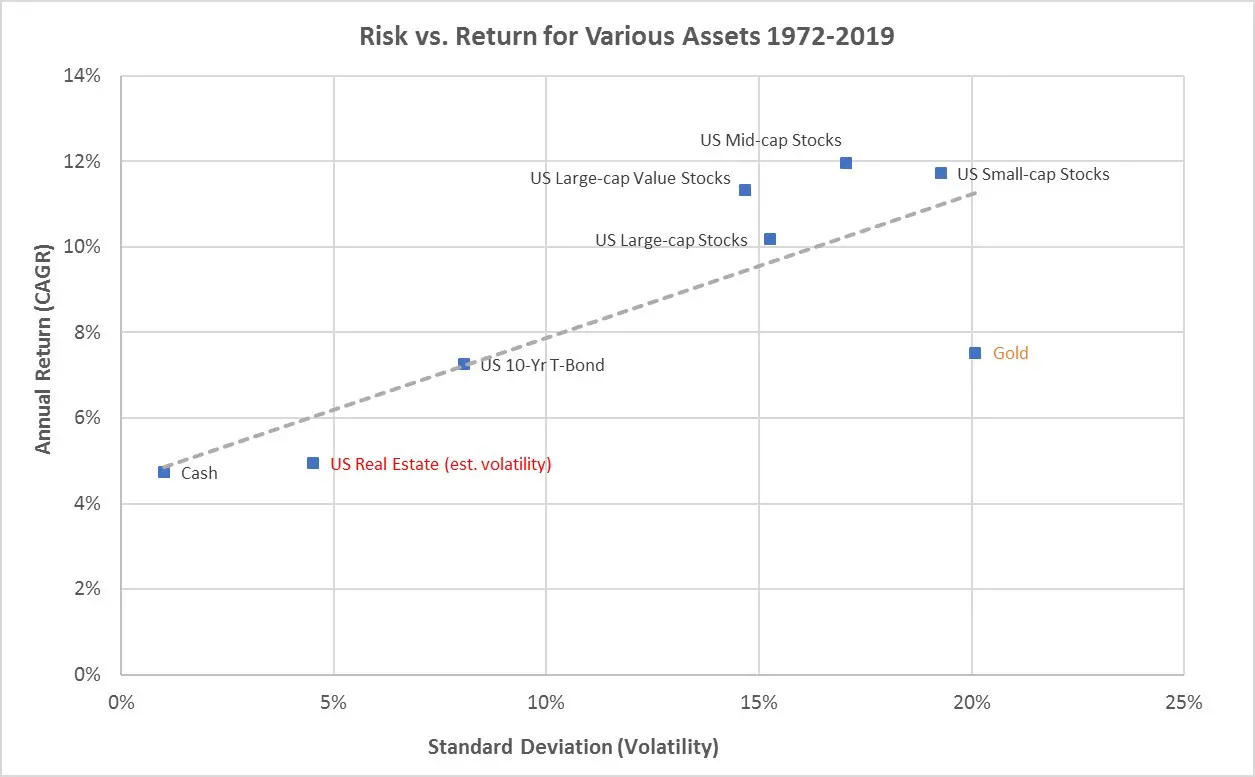

The S&P 500’s historic annual go back is set 10% in comparison to just a 4.6% historic annual go back on actual property. Subsequently, likelihood is that top for those who promote the S&P 500 index to shop for a house with all coins, your transferred capital will underperform over the long term.

The better the proportion of your internet price is in a house in comparison to shares, the slower your internet price might develop. After all, your internet price may just additionally outperform for those who so occur to promote shares sooner than a crash and residential costs outperform shares, as they did from 2000 – 2006.

However general, paying all coins for a house by means of promoting shares will most likely purpose a slowdown within the tempo of your internet price enlargement. Then again, in case you are wealthy sufficient to pay for a house with idle coins, then you might have a greater probability of accelerating your internet price by means of procuring a house with all coins.

As an example, in 2023, you are able to earn ~5% in a cash marketplace fund. But when actual property costs upward push by means of 6.5% by means of July 2024, as Zillow predicts, then the switch of your coins to a house may make you richer. This could particularly be true if rates of interest begin to decline and actual property costs begin to boost up upward.

3) Paying all coins reduces your possible returns on your house

Leverage is excellent at the manner up and harmful at the manner down. Should you pay all coins for a house and costs cross up by means of 5% in three hundred and sixty five days, you earn a 5% gross go back. On the other hand, for those who best put down 20%, then your gross go back to your coins will increase by means of 25%.

The primary approach to develop your internet price quicker with actual property when put next with shares is with a loan. Even supposing actual property is in most cases thought to be much less dangerous than shares, you’ll be able to sarcastically make much more. However that is an editorial about paying all coins for a house.

Possibly one technique is to pay all coins for a house, assess the true property marketplace over the following yr or two, after which do a cash-out refinance in case you are bullish. This fashion, you purchase your self extra time to make a probably extra optimum coins usage determination.

Simply remember that after it is time to get right of entry to your house’s fairness, some banks might now not be offering House Fairness Strains of Credit score (HELOC) or cash-out refinances. Very best to double take a look at together with your financial institution now.

4) You lose an amazing quantity of risk-free source of revenue and safety

You may assume paying all coins for your house would supply you a better quantity of safety. As soon as you have got your house totally paid off, existence is way more straightforward.

On the other hand, this is the irony in a top rate of interest surroundings. If you’ll be able to pay all coins for a space, it approach you additionally be capable to earn a hefty quantity of risk-free source of revenue. This additionally approach you should be forgoing monetary safety.

Let’s consider you’ll be able to pay $2 million coins for a space. Should you had been to simply make investments the $2 million in a 5%-yielding cash marketplace fund, you’ll earn $100,000 a yr risk-free. Nearly all of us and not using a primary well being problems and no debt will have to be capable of fortuitously reside off $100,000 a yr in gross source of revenue. Some may even believe this a Fats FIRE way of life in lower-cost spaces of the rustic.

But when making a decision to make use of your $2 million coins to shop for a house, your $100,000 in risk-free source of revenue is going away. Now not best that, however with a brand new domestic, you’re going to now need to pay further assets taxes, insurance coverage, HOA (the place related), and ongoing repairs bills perpetually.

Therefore, despite the fact that you intend to shop for a house with all coins, I like to recommend following my internet price information for domestic procuring. See the appropriate 3 columns of the chart underneath. I’ll tailor the rule of thumb someday for coins consumers in a brand new publish.

5) You’re going to nonetheless really feel frightened regardless of paying all coins for a house

You’ll assume paying all coins for a house would provide you with super peace of thoughts. In spite of everything, and not using a loan, there is not any financial institution available in the market than can take your house clear of you. Even the federal government may have a difficult time kicking you out if you do not pay your private home taxes. In the meantime, a downturn in the true property marketplace may not wipe away 100% of your fairness.

Paying all coins for a house is just an asset switch. The switch can also be out of your idle coins or from different investments like municipal bonds, shares, and non-public actual property investments. That mentioned, you’re going to nonetheless really feel unsettled in regards to the asset switch since the coins you inject into a brand new domestic turns into unproductive.

You’re going to repeatedly ponder whether there have been higher makes use of to your coins than tying it up in a house you would possibly not want. The one approach to quiet those doubts is by means of developing glorious reports within the new domestic for a number of years. However that takes time.

Your anxiety might make you extra irritable or stressed out. And a bitter temper isn’t excellent to your friends and family.

Therefore, if you’ll pay all coins for a house, you had higher have much more coins and liquid securities at the back of. Through the years, the anxiousness will have to fade as you rebuild your coins or liquid reserves.

6) You need to work out what to do together with your outdated domestic

In case you are these days renting and pay all coins for a brand new domestic, then you haven’t any worries. Give your landlord a 30-day understand or longer that you are transferring out, and you are excellent to head. Simply make sure that your new house is if truth be told able to transport in as soon as your hire is over.

However for those who personal your current domestic and purchase a brand new domestic with all coins, then you have to work out what to do together with your current domestic. Will you rent an actual property agent to promote it? Or will you attempt to in finding renters and construct your passive source of revenue portfolio for monetary freedom?

In my opinion, I really like procuring a assets each and every 3-10 years after which renting it out when it is time to purchase any other number one place of dwelling. Do that over thirty years and you are able to fund your retirement with condominium homes no drawback.

Feeling Fearful About Purchasing A House With All Money

I am taking into account procuring any other domestic with all coins. However now that I am in contract with contingencies, I am second-guessing my determination, as I at all times do.

Possibly I did not want to promote as many belongings and pay all coins within the first position. Given how lengthy the escrow length has been, taking away a loan would were simply superb. However that is roughly like announcing possibly I did not want to have excellent grades and take a look at ratings when I were given accredited to a really perfect faculty!

There is a convenience in seeing other folks purchase properties throughout a bull marketplace. It implies that other folks need what you need and are serving to justify your determination, despite the fact that it can be the incorrect one. However throughout a endure marketplace, you’re feeling like a lonely fish out of water, questioning whether or not the tide will ever go back.

Can other people merely no longer have enough money to pay all coins or take out a loan at those charges? Or are other people ready as a result of they be expecting actual property costs to crash? It is a disconcerting feeling no longer understanding what is retaining other people from profiting from offers.

Why I Introduced All Money

I sought after to make my be offering attractive sufficient for the vendor to simply accept. I used to be providing to pay 14% underneath remaining yr’s asking value and seven.5% underneath this yr’s new asking value. By way of providing to pay all coins, I was hoping to make my be offering horny sufficient for him to believe. Insulting a dealer with a low-ball be offering isn’t find out how to win offers.

To begin with, the vendor declined my be offering by means of his checklist agent. However then a month went by means of and the checklist agent contacted me once more to mention they’d be taking the house off marketplace. This used to be my remaining probability to make a aggressive be offering!

I did not really feel a lot actual property FOMO given I used to be pleased with our current domestic, so I simply stood company on my be offering value. However I additionally determined to spend 35 mins writing an actual property love letter, explaining why my circle of relatives could be a really perfect selection.

The vendor wrote again a letter of his personal announcing how a lot he liked my letter. I had touched upon the entirety from how a lot I valued his transforming, to the significance of circle of relatives, to our mutual love of tennis, and our identical tradition. Possibly writing 2,200+ articles on Monetary Samurai since 2009 has some advantages in spite of everything!

Then I used to be in a position to persuade the checklist agent to scale back her general commissions by means of 2.5% in lieu of her additionally representing me via twin company. She to begin with refused as a result of she did not need to earn much less. However I defined to her she would not be incomes much less as a result of she would have needed to have paid the two.5% fee to a purchaser’s dealer anyway.

I used to be thus in a position to persuade her to present me a minimum of a 2.5% value cut price and simply constitute me. It used to be that, or no transaction in any respect.

Elevating The Stakes By way of Purchasing One thing I Do not Want

As I discussed to my spouse in a earlier podcast episode (Apple), “No one wishes not anything.” We don’t want the rest greater than a studio condo, water, and cereal to live on. In consequence, I continuously query the purpose of shopping for the rest we do not in reality want. We’re frugal people.

Paying all coins for a brand new domestic raises the monetary stakes as it reduces our passive retirement source of revenue. In consequence, I will be able to really feel extra drive to earn more money and develop our internet price additional.

The primary two years of possession will stay me in a heightened state of tension as a result of our funds will likely be maximum in danger. The anxiousness may not be debilitating to the purpose the place I will not be able to sleep or serve as. It’s going to simply be upper than I am used to since leaving paintings in 2012. I am hoping I will be capable of adapt.

Possibly I will be able to use this anxiousness as motivation to write extra books and/or discover a well-paying process. When my son used to be born in 2017, my motivation to earn shot during the roof! Additional, I plan on giving up on early retirement anyway as soon as each youngsters cross to university full-time in 2024. So the celebrities appear to align.

In conclusion, pay attention to the downsides of paying all coins for a house. Use your all-cash be offering to get a lower cost after which briefly refill your coins reserves after you shut. Should you do, you’ll be able to really feel significantly better about your acquire.

Reader Questions And Ideas

Have you ever paid all coins for a house sooner than? If this is the case, how did you’re feeling? What are another downsides to shopping for a house with coins?

Shouldn’t have all coins to shop for a space? No worries. You’ll put money into non-public actual property with Fundrise with as low as $10. Fundrise budget essentially invests in residential and commercial homes within the Sunbelt, the place valuations are decrease and yields are upper.

Concentrate and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview mavens of their respective fields and speak about one of the crucial maximum attention-grabbing subjects in this website. Please percentage, price, and assessment!

For extra nuanced private finance content material, sign up for 60,000+ others and join the unfastened Monetary Samurai publication and posts by means of email. Monetary Samurai is without doubt one of the biggest independently-owned private finance websites that began in 2009.

[ad_2]