[ad_1]

This put up is a part of a sequence subsidized through Insurance coverage Quantified.

“I Know, You Don’t Have Time to Learn This. You’re Drowning in Submissions.”

I’ve had the chance to spend a part of my profession serving to insurance coverage carriers and their underwriting groups to extend their submission waft within the face of failing premiums and a reputedly bottomless pit of capability. At the moment, with premiums and thus commissions at the decrease facet, it made numerous sense for carriers to concentrate on consumer acquisitions. It was once a herbal alternative to truly center of attention on construction out distribution networks and deepening relationships.

Nowadays, the marketplace dynamics have modified for a number of markets, most likely because of the present onerous marketplace, and I as a substitute listen steadily from underwriting groups which are drowning in submissions.

Those cases of submission overload appear to be maximum commonplace in the ones merchandise and industries hit toughest through the toning marketplace, particularly in Extra & Surplus (E&S), the place the marketplace has grown through 20%. I’ve heard stories of shared submission e mail inboxes which are overflowing with submissions that haven’t been touched or spoke back to, to not point out the ones sitting in underwriters’ private inboxes. To start with blush, this may increasingly sound like a pleasant drawback to have, however is it truly?

Good fortune within the insurance coverage business is rooted in relationships, specifically for underwriters, who spend their careers cultivating partnerships. Underwriting groups will have to be responsive to be able to care for their relationships and develop their distribution networks. If submissions are falling in the course of the cracks, some savvy agents will take steps to get your consideration in order that their shoppers can get quotes, however others will simply write you off.

The trade advantages of responding to all submissions transcend cementing a name for being well timed and responsive. It additionally unlocks the chance to cite extra trade and thus write extra top rate, as inventions like more uncomplicated get right of entry to to knowledge and smoother workflows facilitate a extra scalable underwriting procedure general.

The Trade Case for Systematic Prioritization

Once I communicate with underwriting groups, I regularly ask them what their submission-to-quote ratio is. Some can solution that query, however those that are actually drowning in submissions most often do not know. How may just they, once they don’t totally perceive the scope in their submission influx? On the other hand, what nearly each and every underwriting staff does know is their quote-to-bind ratio, which is a key consider discussing why underwriting groups wish to regain keep watch over of the overflowing submission inbox.

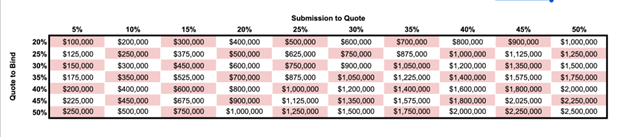

To lend a hand illustrate this, I’ve equipped a desk that appears on the financial have an effect on of adjustments in a service’s quote charge. This elementary instance seems at a median coverage measurement of $10,000 with 1,000 submissions monthly.

Let’s read about the quote-to-bind ratio of 20%. With each and every 5% building up in submission-to-quote, this company realizes an extra $100,000 in top rate a month or $1.2 million a 12 months. But when the quote-to-bind ratio will increase to 50%, a 5% development in submission-to-quote yields $250,000 a month in top rate or $3 million a 12 months. The 5% building up is a elementary benchmark determine, however this grows having the ability to quote extra trade, assuming the quote-to-bind ratio stays constant as the amount will increase.

One of the crucial counterarguments to this might be that no longer all of the ones submissions would fall into your urge for food, so how may just you quote them? That is indisputably true, nevertheless it’s additionally the case that understanding extra about all the ones submissions that you’re these days lacking allows you to higher paintings along with your distribution companions to know your urge for food and in all probability create new product choices higher aligned along with your distribution.

Via now, optimistically you compromise that it makes just right financial sense to be able to deal with all the ones untouched submissions to your inbox. Finally, this trade cycle will ultimately transfer on and scale back those volumes, so now’s the time to take advantage of them and no longer squander essential relationships. The important thing query: how are you going to all at once in finding the time to deal with a lot of these submissions?

Key Tech Features for Underwriting Prioritization

Thankfully, there’s era for that. Discovering the correct resolution comes down to putting together the correct set of functions to satisfy what you are promoting necessities. On this explicit use case, corporations which are inundated with submissions can receive advantages significantly from discovering an answer that won’t best entire the consumption procedure in a well timed, correct means, however too can observe laws that lend a hand prioritize and in the end floor the most efficient alternatives for underwriters to concentrate on. As you might be comparing era answers, listed here are some core functions to search for:

#1: Turning the mass of submissions into actionable knowledge for underwriting

One of the crucial key ache issues we listen is round getting knowledge out of the inbox and right into a usable layout for underwriting. Strangely, that is nonetheless a extremely handbook procedure, with other folks regularly compelled to go into knowledge more than one instances, which takes time and will increase doable for human error. Ingestion era leverages AI and gadget studying methodologies to extract the important thing knowledge had to review submissions and convert them right into a constant, usable layout.

#2: Validating and embellishing the ingested knowledge via verified, third-party assets

Extracting data is essential, however even properly formatted knowledge incessantly has gaps and wishes verifying sooner than you’ll name it entire and in a position for an underwriter. That is the place enrichment as an ability is available in. Via layering third-party knowledge assets on best of your ingested knowledge, you’ll fill data gaps, decreasing back-and-forth along with your dealer whilst additionally construction in tests and balances to validate the standard of the tips and scale back doable chance to what you are promoting.

#3: Taking the newly got knowledge asset and covering what you are promoting necessities

With this newly entire knowledge asset at your fingertips, the remaining step within the procedure is making use of some form of good judgment to lend a hand temporarily floor the most efficient alternatives. There are workflow gear that assist you to set laws particularly for what you are promoting necessities which are then mechanically carried out to all finished submissions. The outcome is a complete software ranking carried out to your whole submission pipeline that you’ll use to simply prioritize spaces of center of attention and make knowledgeable, environment friendly selections.

Subjects

Business Strains

Trade Insurance coverage

Underwriting

[ad_2]