[ad_1]

LISTEN TO A PODCAST ON THIS TOPIC

WITH S&P GLOBAL MOBILITY EXPERTS

Simply what you sought after: But some other research

relating to automobile electrification. However undergo with us; this one is

vital studying. Sure, the battery-electric automobile (BEV) marketplace

is setting out, possibly at a extra fast clip than some have

predicted. However that doesn’t imply the business is home-free in

transitioning from the inner combustion technology to BEVs. Even supposing

forecasted marketplace call for crosses the chasm to mass adoption, there

are a number of main impediments to BEVs changing into the de facto

transportation propulsion know-how. Those that don’t take heed

are destined to fail.

For all of the fervor of early adopters predicting

this shipping transition as progressive as that of horses to

automobiles, there is a sure fragility to the present BEV motion. The

effort and cajoling required to carry hearth to lifestyles — from

demand- and supply-side incentives to technology-forcing legislation

and law — is certain to be extra at risk of roadblocks

in comparison to one evolving organically.

The equation of attaining mass-market adoption

of electrified automobiles is as-yet unproven. And whilst sure

markets — be it mainland China or San Francisco —

are embracing a BEV long term, inventories of BEVs in

the USA marketplace are appearing early indicators of stacking up on

dealership showroom flooring. As such, it’s nonetheless a ways from a

real looking mass-market proposition. Whilst BEVs attaining value

parity with their inside combustion engine (ICE) opposite numbers

will liberate the keys to the door marked “mass-market,” there are

nonetheless residual problems that want addressing instead of attaining

supply-and-demand equilibrium at mass-market quantity. A large number of different

actions in play will have to be carried out to make sure BEVs don’t seem to be only a

one-and-done phenomenon.

If a hit, alternatively, the electrification

transition will upend the business’s infrastructure, economics,

applied sciences and supporting services and products in some way that stakeholders are

most effective simply beginning to cope with and comprehend. Some shall be left

maintaining the reins of a disappearing industry simply as homeowners of

horse-drawn carriage firms skilled over 100 years in the past.

The newest S&P

World Mobility forecast main points the important thing sides of the

electrification push that want cautious tracking to make sure the

smoothest proceeding transition for all stakeholders.

A caution concerning the delivery

chain

Within the ICE technology, the car sector changed into

well-versed in coping with delivery chain chance. Now with

electrification, the parameters have modified; chance is now offered

additional upstream from the sphere’s commonplace nation-states of operation.

Earlier delivery chain snarl-ups and surprises

— such because the Xirallic pigment scarcity from the Japan

earthquake/tsunami in 2011, and the pandemic-triggered

semiconductor disaster — will appear diminutive when compared.

Those disruptions triggered greater center of attention on delivery chain

visibility, however within the electrification technology, the reliance on sure

uncooked fabrics and portions may provide its personal set of demanding situations on

a regimen foundation.

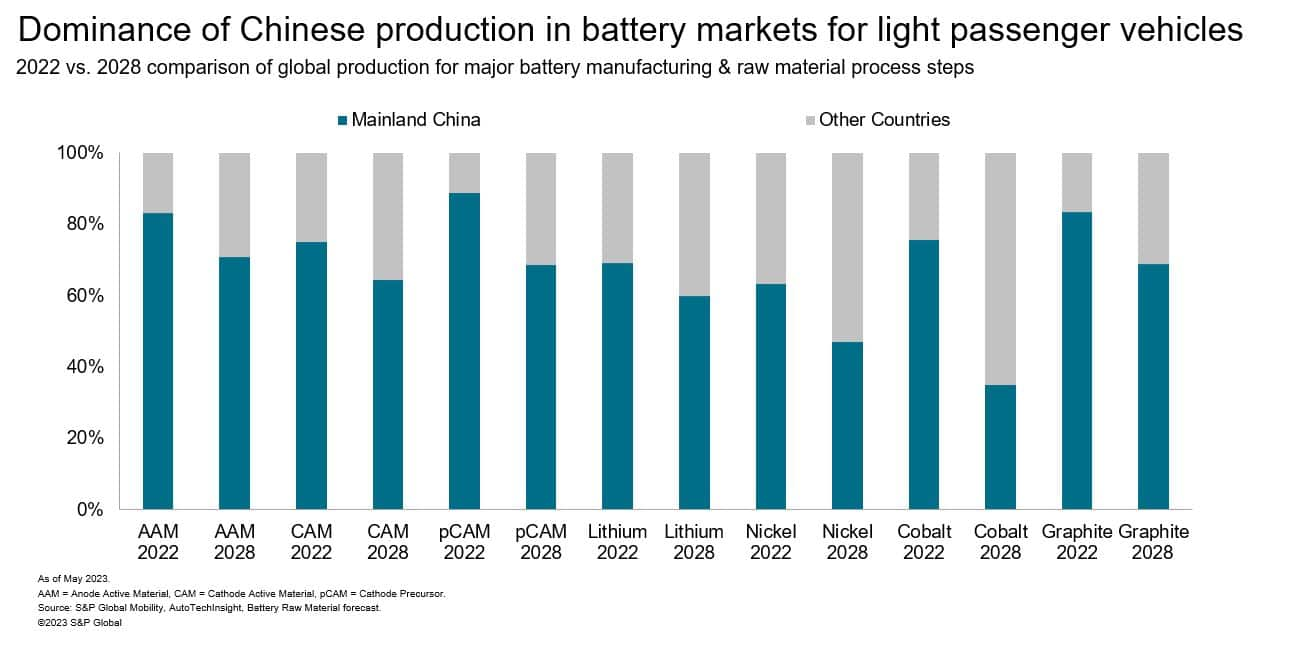

Efforts via mainland China’s auto business to

identify a first-mover place all over the BEV delivery chain

were a hit. The primary items of creating the EV

battery — the cathode and anode within the traction-battery cells

and the pack itself — in addition to vital stakes in

inverters, converters, controllers and charging tech were

snapped up via the mainland Chinese language provider base. In the meantime,

laggard areas are making plans to make use of legislative levers for a

semblance of regulate and to meet up with mainland Chinese language

opposite numbers. We think one of the vital hole to mainland China to be

clawed again because the marketplace expands and the range of battery

chemistries continues.

On the other hand, the ones parts are not anything with out

their uncooked fabrics, and mainland China additionally holds a bonus

— both in gaining access to the ones components in the community or sourcing them

from different international locations by means of an competitive commerce coverage. The next

representation highlights S&P World Mobility’s Might 2023 forecast

for key uncooked fabrics and their sourcing.

When it comes to battery uncooked fabrics, a delivery crunch

may exist inside this decade. For lithium, we forecast a sixfold

build up in call for between 2022 and 2030 from some 0.06 million

metric heaps to 0.37 million metric heaps for gentle passenger automobile

programs by myself. In conjunction with the S&P World Commodity

Insights group, we additionally be expecting lithium markets shall be in deficit via

2027, making a bottleneck for car delivery. Solution will

be sluggish as lithium takes on reasonable 15.7 years to succeed in the marketplace

after preliminary discovery. Therefore the new center of attention on battery

recycling.

Different composite components of the cathode —

the costliest a part of the battery — dominate considerations

round uncooked fabrics. Our forecast displays the pursuit of

greater power density via extra nickel-rich chemistry,

coupled with a rising need to restrict its use to programs

the place the variety is important. Lithium iron phosphate-derived

know-how shall be decided on with expanding regularity in

lower-cost programs.

On the other hand, along with lithium and nickel,

cobalt is a key part in battery chemistry. Sourcing of cobalt

— of which 75% of the sector’s present delivery comes from the

bothered Democratic Republic of Congo — gifts a snag for any

corporate trumpeting an ESG or sustainability

ethos. Firms are in search of change tactics to supply

in other places via the top of the last decade — in addition to to procedure this

part, as mainland China dominates this hyperlink of the availability chain

as nicely.

It isn’t most effective in battery uncooked fabrics that

mainland China has established an eminent place. It enjoys a

lofty place for the uncommon earth components vital for electrical

motors. This has just lately been introduced sharply into center of attention via

mainland China’s announcement that it desires to regulate exports of

gallium and germanium, leading to many outdoor international locations briefly

reassessing their delivery chain publicity.

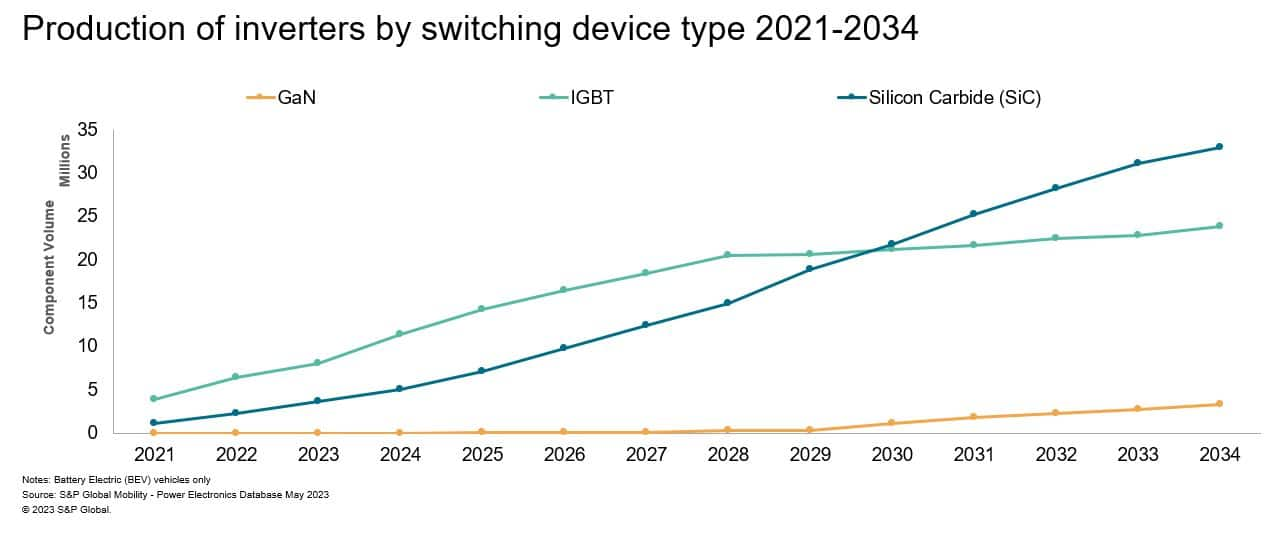

Gallium is a subject matter vital for sure

energy digital parts. Energy electronics corresponding to inverters,

DC-DC converters and onboard chargers are being remodeled to

surround extra environment friendly designs the use of silicon carbide (SiC)-based

chips, promising greater semiconductor call for and the

accompanying delivery demanding situations. The expansion of silicon carbide-based

inverters is proven within the following chart.

There also are the apparently mundane metals,

corresponding to copper, which is already beneath vital drive, and business leaders are

predicting a scarcity via the top of the last decade. Manganese may

even be deemed ample given its use within the metal business, but

battery-grade amounts of the specified electrolytic manganese

dioxide (EMD) are in relatively

quick delivery, particularly in free-trade settlement international locations.

Amid this shift, automakers are growing

in-house answers to say some extent of safety over nascent

delivery chains. With such prime stakes, relationships between OEMs

and Tier 1s are inevitably strained.

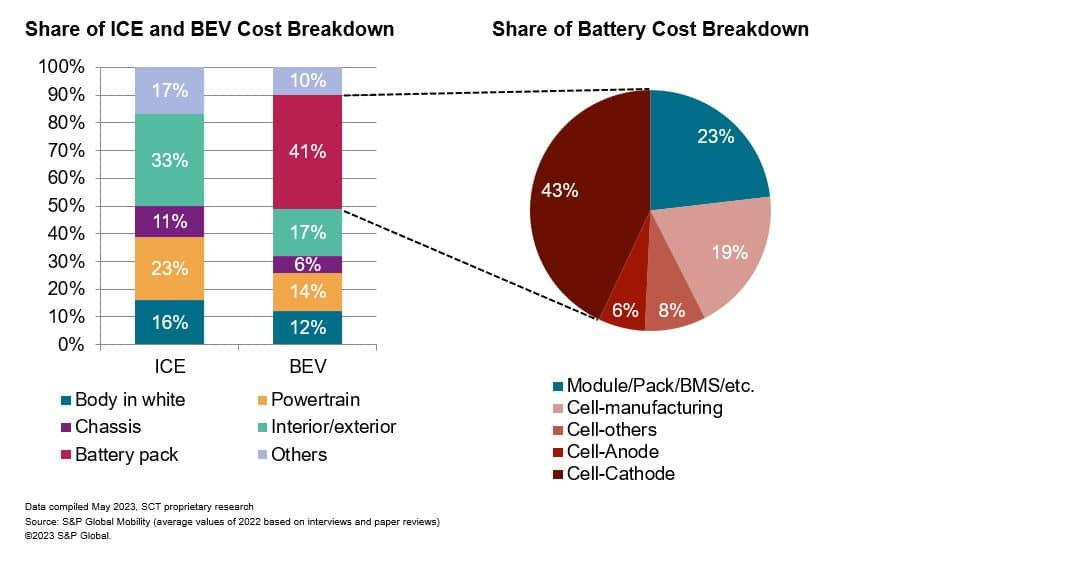

On account of the chip scarcity, a richer

portfolio combine has allowed OEMs to succeed in greater margins throughout

their product traces, giving headway to fund BEV transitions. For

Tier 1s, there was no such dividend. As BEVs are basically

more effective, in-house manufacture of the battery, propulsion device and

energy electronics will lead to OEMs having duty for a

a lot greater share of the automobile’s price — piling drive on

providers.

There may be the producing aspect of the

equation that will depend on those part portions. Apart from precise

BEV call for, battery capability according to automobile is a enlargement vector —

reasonable capability is forecast to extend from 60 kWh to 78 kWh

— contributing to international call for all the way through 2023-30 expanding from

540 GWh to a few.4 TWh.

Given this build up, battery-cell production

capability will have to build up in tandem. Consequently, we think the full

theoretical production capability (for gentle passenger automobiles)

to extend from 1.35 TWh to 4.5 TWh via 2028, with the collection of

battery-cell production vegetation emerging from 107 to 188 globally.

If building schedules are met, there shall be enough

capability — certainly some underutilization will happen.

Who owns the propulsion

know-how?

OEMs historically are chargeable for their

engine and, in some instances, transmission necessities. However they now face off

in opposition to Tier 1 powertrain providers to carry e-axles and their

subcomponents in-house. For relatively low quantity

first-generation BEVs, OEMs in large part outsourced to Tier 1

experts. Now they’re bringing extra of the built-in,

three-in-one (motor, transmission, and inverter) e-Axles to their

personal amenities. Our newest knowledge display over 75% of OEMs now carry out

the e-Axle integration actions in-house.

Without reference to who builds e-Axles, via 2025, 80%

of eAxle-based motors will want the aforementioned uncommon earth

components germanium and gallium. Consequently, we estimate that nicely

over 90% of the sector’s production-ready magnets shall be mainland

Chinese language-manufactured.

Alternatives for providers stay within the motor

meeting, with 47% of motors produced in 2023 being outsourced. However

as volumes build up, those delivery chain alternatives will evolve

because the motor shall be damaged into subcomponents like rotor and

stator assemblies. Already Tier 1s are profiting from those

alternatives. On the other hand, the e-Axle is a cautionary story as to how

an OEM’s sourcing remit can exchange — whilst seeking to stay their

employment numbers stable all the way through the transition.

A 2d factor for motors — garnering fewer

headlines, however the topic of previous S&P World Mobility

analysis — is the loss of thin-gauge electric metal

capability required for meeting. Issues persist, with extra

funding in electric metal capability had to meet burgeoning

call for.

There are not sufficient

chargers

As soon as the automobiles are constructed, then comes the

“refueling” equation. The BEV paradigm opens the chance to

recharge the automobile in a mess of domain names with the exception of

standard public refueling infrastructure acquainted to gas

provider stations. On the other hand, for now, public charging choices are

constrained via no longer simply the volume of chargers

to be had but in addition the reliability of the stations, the

supply pace {of electrical} energy, and the battery’s talent to

obtain it.

There is also the relative first-world nature

of BEV charging, as growing international locations won’t have the

infrastructure grid to enhance a mass charging community. Due to this fact,

a lot of the underdeveloped international will most likely stay an

internal-combustion haven for the foreseeable long term.

On the other hand, for the ones international locations with a strong,

operational grid, how briskly does energy want to be delivered into the

automobiles to fulfill shoppers? The 179 million chargeable automobiles

forecast to perform via 2030 (143.5 million BEVs and 35.5 million

plug-in hybrid electrical automobiles) could have various

necessities.

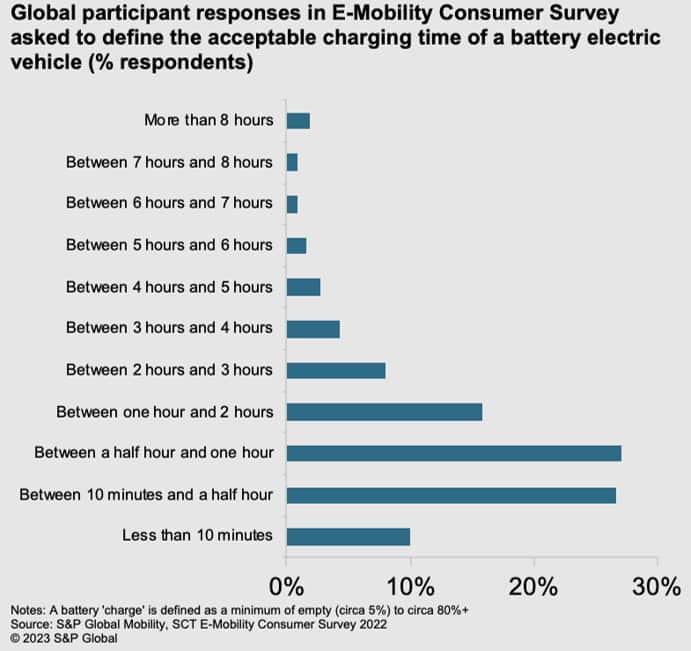

Grids can not enhance rapid charging all over

always. In S&P World Mobility’s 2022 E-Mobility Client

survey, nearly all of international respondents contended {that a}

price time of between 10 mins and two hours for a complete price

(regarded as to be 80% via conventional business requirements) could be

appropriate. However just about two-thirds sought after it to be carried out in much less

than an hour.

BEV charging wishes are situation-specific, with

customers desiring the best pace of energy supply relying on their

reside time and adventure profile. Whilst BEV adopters thus far

predominantly price at domestic, this is probably not a workable answer

for all.

Moreover, for BEV charging suppliers,

turning in a quick price won’t at all times serve their absolute best pursuits.

A burgeoning ecosystem is growing across the “30-minute retail

financial system” thought, which sees the chance to provide winning

services and products to customers whilst they stay up for public BEV charging. One of these

retail ecosystem will supply price level operators with a explanation why

to scale, and assist advances in charging know-how if retail

earnings are reinvested.

With the evolution of EVs, charging know-how

will support as higher-voltage architectures are followed, bringing

quicker receipt of energy. They’re going to be enabled via the adoption of

awesome energy semiconductor know-how. Our knowledge presentations the quantity

of silicon carbide-based inverters will build up sixfold between

2023 and 2030 on their strategy to changing into the dominant inverter kind

via 2034.

A abstract research of our newest forecast

projections may also be present in our EV Charging

Infrastructure Record & Forecast.

Optimum vary as opposed to thermal

control

Inside the context of assessing charging

infrastructure wishes, the BEV’s vary dictates how regularly it wishes

to be charged and, doubtlessly, the place it’ll be charged. Crucial

here’s a battery capability of enough dimension to enhance vary

necessities. Much less understood is the numerous function of thermal

control in getting a producer’s quoted all-electric vary to

replicate the “actual international” vary.

For BEVs available on the market in 2023, the typical

all-electric vary quoted is a few 6.3 kilometers according to kWh of battery

capability. S&P World Mobility analysis estimates that some 28%

of the variety is misplaced the use of air con all over the power

cycle. As proven, this may also be decreased to fifteen% the use of warmth pump

know-how. Rather then how the automobile is pushed, thermal

control is the most important parasitic loss for a BEV, save for an

remarkable use case corresponding to towing.

Warmth pump applied sciences, built-in thermal

modules (ITMs) and optimized battery preconditioning may also

carry potency financial savings. Whilst coolant-cooled battery answers

will change into common, area of interest improvements in battery cooling

know-how, corresponding to immersion cooling, will enhance within the

temporary. As depicted beneath, thermal control of the BEV is a

enlargement alternative for providers with the financial price

contribution of thermal control to an electrical automobile

expanding 83% when compared with an ICE an identical.

Lately, the thermal control device is a

marketplace of few avid gamers however gifts a significant alternative. Persevered

consolidation on this area via M&A to assist providers

construct scale and countervailing the OEMs’ energy may also be anticipated.

EVs for all? And earnings for

all?

This confluence of the above technological and

logistical demanding situations triggers the will for BEVs to be to be had to

as wide a buyer base because the incumbent ICE know-how. They will have to

attraction for his or her key benefits and no longer be constrained via current

obstacles.

To verify this, the price of BEV know-how will have to

decline, and margins be enough for each OEMs and providers to

thrive in a posh geopolitical atmosphere. Fresh analysis the use of

S&P World Rankings knowledge confirmed that EBIT margins for OEMs

at the moment are constantly surpassing the ones in their providers —

bucking historic developments. Whilst a couple of components give a contribution, OEMs

are squeezing providers to make sure sustainable profitability for

their fledgling BEV companies. In the meantime, legacy OEMs and

providers will have to organize the transition from ICE to BEV to make sure a

strong waft trail and no longer overextend.

The evolution of battery, charging, propulsion,

and thermal control know-how shall be a very powerful for the

ubiquitous adoption of BEVs. Whilst scale inevitably is helping,

technological construction remains to be required to make mass-market

BEVs a product evolution inevitability fairly than a

subsidy-induced and government-mandated novelty.

————————————————————–

Dive deeper into those mobility insights:

Electrification know-how

in reshaped delivery chains for ubiquitous EVs

Be informed extra about electrical

automobile developments from our newest insights and

answers

The problem of sourcing

EV battery minerals in an ESG international

Now To be had: Best 10

Business Traits Record

The struggle for e-drive

supremacy: Make vs. Purchase

[ad_2]