[ad_1]

When will the hurting forestall? Given low housing provide, house costs were expanding at the same time as rates of interest upward push

2022 has been a difficult 12 months for the markets and particularly for residential actual property. People having a look to buy a house were negatively impacted by way of emerging loan charges, that have considerably greater the price of their anticipated per thirty days loan cost.

Certainly, loan charges have risen considerably, including to the price of a loan. Consistent with Bankrate.com, the 30-year nationwide loan fee ![]() has greater 344 foundation issues to six.67% as of eleven/30/2022 (from 3.23% a 12 months in the past). Whilst increased, this contemporary 30-year loan fee is a slight development from the 12-month top of seven.35% seen on 11/3/2022. All through this similar length, the median house worth greater 3.49% to $370,700 (from $355,700 a 12 months in the past) in line with the Nationwide Affiliation of Realtors (NAR) document on current house gross sales

has greater 344 foundation issues to six.67% as of eleven/30/2022 (from 3.23% a 12 months in the past). Whilst increased, this contemporary 30-year loan fee is a slight development from the 12-month top of seven.35% seen on 11/3/2022. All through this similar length, the median house worth greater 3.49% to $370,700 (from $355,700 a 12 months in the past) in line with the Nationwide Affiliation of Realtors (NAR) document on current house gross sales ![]() . NAR famous “This marks 129 consecutive months of year-over-year will increase, the longest-running streak on report.” The will increase in rates of interest and median house costs have led to possible patrons’ per thirty days loan cost (the sum of the primary and passion) to spike a whopping 53.36% to $1,907.74 (from $1,243.98 a 12 months in the past). The desk under illustrates the alternate in per thirty days cost, assuming a 20% down cost.

. NAR famous “This marks 129 consecutive months of year-over-year will increase, the longest-running streak on report.” The will increase in rates of interest and median house costs have led to possible patrons’ per thirty days loan cost (the sum of the primary and passion) to spike a whopping 53.36% to $1,907.74 (from $1,243.98 a 12 months in the past). The desk under illustrates the alternate in per thirty days cost, assuming a 20% down cost.

| As of | 11/30/2021 | 11/30/2022 | Alternate | |

| Median House Worth in line with NAR Current House Gross sales |

$ 358,200.00 | $ 370,700.00 | 3.49% | |

| Down Cost (20%) | $ 71,640.00 | $ 74,140.00 | ||

| Loan Period (30 Years) | 360 | 360 | ||

| 30 12 months Loan Price in line with Bankrate.com Nationwide Reasonable | 3.23% | 6.67% | 3.44% | |

| Per month Cost (Fundamental and Hobby) |

($1,243.98) | ($1,907.74) | 53.36% |

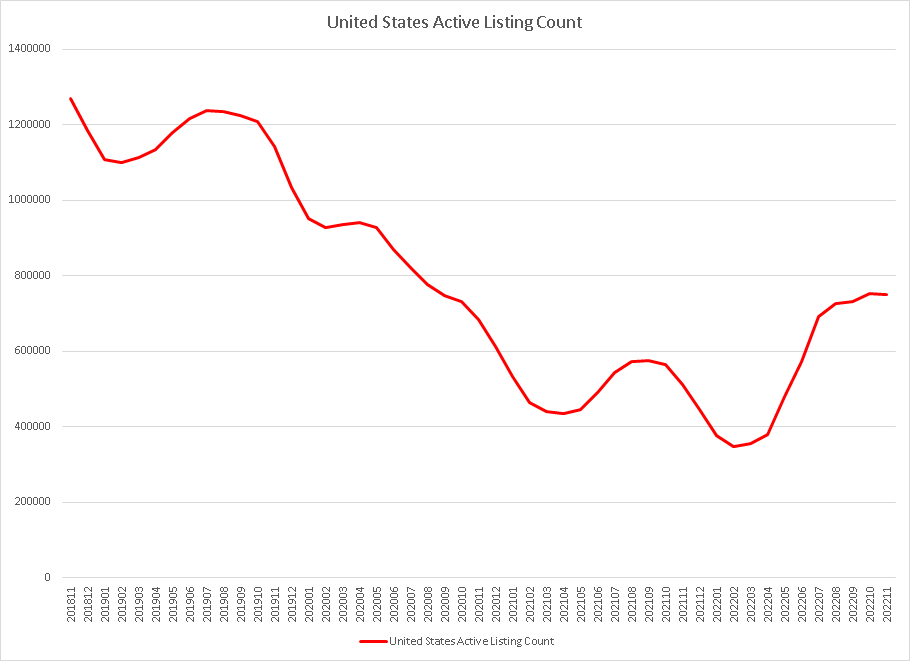

In spite of this dramatic build up in per thirty days bills at the acquire of residential actual property, house costs have persisted to upward push to this point this 12 months. One of the vital causes for the resilience in house costs seen is that the to be had housing stock marketplace stays “tight” (which means provide is restricted). Realtor.com publishes information for lively residential actual property listings. ![]() . Taking a look nearer at this information, the choice of lively listings has greater slightly over the process 2022 to roughly 752,000 gadgets (as of eleven/30/2022). Alternatively, this contemporary statement stays somewhat low when in comparison to the former 5-year moderate for this time of 12 months of 872,000 gadgets. This quantity could also be part the absolute best choice of lively listings all the way through this time period of one,271,000 gadgets (seen 11/30/2018).

. Taking a look nearer at this information, the choice of lively listings has greater slightly over the process 2022 to roughly 752,000 gadgets (as of eleven/30/2022). Alternatively, this contemporary statement stays somewhat low when in comparison to the former 5-year moderate for this time of 12 months of 872,000 gadgets. This quantity could also be part the absolute best choice of lively listings all the way through this time period of one,271,000 gadgets (seen 11/30/2018).

Of their liberate, NAR Leader Economist Lawrence Yun mentioned that “In essence, the residential actual property marketplace used to be frozen in November, comparable to the gross sales process observed all the way through the COVID-19 financial lockdowns in 2020 … The primary issue used to be the fast build up in loan charges, which harm housing affordability and lowered incentives for house owners to listing their houses. Plus, to be had housing stock stays close to historical lows.”

The information obviously displays the residential housing marketplace is tight. This commentary could also be affirmed by way of the present house gross sales document, which states there may be recently a three.3 month provide to be had available in the market. Within the residential housing marketplace, it’s mentioned that this is a dealers’ marketplace when there may be not up to a 6 month provide to be had, and a patrons’ marketplace when there may be more than a 6 month provide. Consistent with the information, it sounds as if that we proceed to be in a dealers’ marketplace. This dealers’ marketplace is going on even with the numerous build up in per thirty days loan bills which are being negatively impacted by way of emerging loan charges.

It continues to be observed if the continuing build up in residential house costs can happen going ahead. I imagine that costs will want to decline to ease patrons’ ache given the 12 months’s vital build up in loan charges. This anticipated lower in costs must make the residential housing marketplace extra obtainable and make allowance folks to buy a house extra cost effectively.

Washington Agree with Financial institution believes that the ideas used on this learn about used to be received from dependable resources, however we don’t ensure its accuracy. Neither the ideas nor any opinion expressed constitutes a solicitation for industry or a advice of the acquisition or sale of securities or commodities.

About The Creator

Nick is a Vice President and Portfolio Supervisor for Washington Agree with Financial institution’s Wealth Control & Advisory Products and services. He provides our shoppers the experience to investigate portfolios and distinctive belongings to make sure that they’re appropriate for assembly our shoppers’ objectives and desires.

Nick companions with our Dating Managers to supply chronic research to make sure that those custom designed portfolio answers deal with the steadiness between possibility and expansion with a view to be sure that persisted good fortune in assembly the shoppers’ objectives.

[ad_2]