[ad_1]

Banks and different incumbent cost avid gamers face an intriguing paradox at the moment. They will have to innovate to stick related, however their discretionary budgets for innovation are restricted. They will have to give you the option to do extra with much less.

Fast enlargement within the bills marketplace, which is attracting quite a lot of new worth propositions and competition, provides to the urgency. Many of those new choices, from embedded bills and finance to digital obtaining and past, are all of a sudden gaining marketplace proportion.

Klarna, Stripe and PayPal are all reasonably fresh startups that grew to keep watch over vital parts of quite a lot of portions of the bills worth chain. BNPL specialist Klarna, as an example, not too long ago reported overall web working source of revenue of five billion krona (more or less $466 million). Stripe’s marketplace cap has fallen from its 2021 valuation, however nonetheless sits at round $50 billion.

Apple Pay, in the meantime, is predicted to deal with 10% of worldwide card transactions via 2025, whilst Accenture research tasks that fintechs will keep watch over 57% of cross-border bills via that point. Additional research via our analysis workforce means that $89 billion in financial institution cost revenues can be in peril within the subsequent 3 years if card-issuing banks did not innovate.

Banks and different incumbents are desperate to compete with those more moderen cost products and services suppliers. However they frequently will have to achieve this with one hand tied in the back of their again. Accenture’s enjoy operating with massive monetary establishments means that more or less two-thirds of bills trade spend is devoted to regulatory and different obligatory prices. Discretionary spending for cutting edge bills tasks is typically lower than a 3rd of the full bills trade price range.

But the instant to transport is now. The existing macroeconomic local weather, whilst no longer with out its demanding situations, items banks with a possibility to speculate counter-cyclically in bills to trip the wave when the cycle reverses. With almost-free capital drying up around the marketplace (together with for cost fintechs), that is the time for banks to catch up.

Discretionary spending oncutting edge bills tasks is typically lower than a 3rd of the full bills trade price range.

Incumbents due to this fact face an ordinary alternative these days to get again within the shopper bills innovation race. The an important query is how.

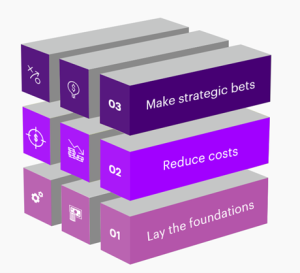

From the best degree, we see this as a three-stage funding that may stay the display at the highway whilst additionally putting in destiny enlargement.

1. Lay the principles. Proceed to make certain that the financial institution’s core infrastructure each allows compliance with converting laws and helps very important modernization and transformation efforts. Cloud migration and core modernization are the secret right here.

2. Scale back prices and optimise operations. Establish discrete alternatives for financial savings with the correct mix of era—together with automation and AI to scale back handbook effort—and successfully spouse to leverage capacity and scale.” This will likely scale back rate and run prices and create capability to speculate with extra discretion.

3. Make strategic bets. The 3rd step—the person who calls for renewed center of attention now—is crafting and executing a well-defined technique to offer protection to and develop cost income streams. This will likely require centered investments in next-gen virtual bills gear like embedded bills and finance, virtual wallets, stepped forward FX propositions, enhanced transaction banking, and pilot CBDCs the place appropriate. Neatly positioned bets will permit a financial institution to reinforce its cost features, future-proof its methods, and spice up buyer retention. It is going to call for good partnership choices and the size of good fortune in the case of strategic results.

Step one establishes an incumbent’s proper to compete in these days’s bills panorama and the second one helps to keep it within the contest. The general step describes the way it can win—and there are lots of possible paths to victory. A few of these will transcend conventional techniques of doing industry in bills. The brand new frontier of festival is the client enjoy.

Notable examples of incumbents making strategic bets to compete from the previous couple of years come with:

- Singapore financial institution DBS, which since 2018 has presented quite a lot of partnered shopper studies thru its Market platform. DBS shoppers should buy or promote vehicles, to find an internal clothier, or even take accounting classes during the platform.

- American incumbent JPMC’s plan to release a full-service shuttle company.

- NatWest’s banking-as-a-service play introduced ultimate 12 months.

- Virgin Cash’s virtual pockets, introduced ultimate 12 months, with integration into Virgin’s broader rewards ecosystem.

- Santander’s PagoNxt venture, which introduced as an impartial fintech-style international bills platform.

Watch the video: Accenture’s Sulabh Agarwal on Unlocking Alternatives with Emerging Passion Charges and Key Funding Issues for Banks from EBA Day 2023

Banks and different incumbents that may understand the best returns on their restricted discretionary innovation investments in bills can be the next day’s marketplace leaders. There’s not anything much less at stake with those alternatives than reinventing the cost enjoy and fuelling the expansion of the industry for years yet to come.

Obtain the total file, “Bills will get non-public: The way to stay related as shoppers search keep watch over,” To talk about how your bills group can get again within the bills innovation race, touch Sulabh or Amit.

Thanks to Will Hay for his beneficiant contributions to this text.

Disclaimer: This content material is equipped for basic knowledge functions and isn’t supposed for use instead of session with our skilled advisors. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

[ad_2]