[ad_1]

A couple of daring banks are starting to see the advantages of operating in combination to tame provide chain emissions. They’re sharing concepts about how they may be able to extra as it should be measure those Scope 3 emissions which can be generated via their providers. And, maximum essential, they’re exploring techniques to cut back them. The discussions contain a number of large retail banks and so they’re being co-ordinated via Accenture.

If all is going smartly, the talks will produce suggestions sooner than the tip of this yr that can lend a hand banks throughout the United Kingdom curb emissions from their provide chains. The suggestions may provide organisations such because the Carbon Disclosure Challenge (CDP), the Greenhouse Fuel Protocol and the Web 0 Banking Alliance with treasured views on how the banking trade in many nations may classify, baseline and in the long run cut back such emissions.

“Cuts in provide chain emissions within the banking trade would most likely cause discounts in different sectors.”

Motion to lend a hand banks take on emissions via their providers is necessary. As mentioned in our Emerging to the Problem of Web 0 Banking file, Scope 3 emissions are via a long way the largest supply of financial institution emissions—greater than 95%. And a piece of those are “upstream” emissions produced via financial institution providers and contractors. Banks are increasingly more addressing “downstream” emissions, generated via firms of their lending and funding portfolios. However they’ve tended to carry again on tackling provide chain emissions.

Via stepping up efforts to curb greenhouse gasoline emissions generated via this actual supply, banks may advance their quest to turn into sustainable organisations. They’d transfer nearer to lowering their carbon footprint to internet 0. Larger cooperation with providers and contractors may also allow banks to proportion value financial savings and to capitalise on new trade alternatives.

Additionally, cuts in provide chain emissions within the banking trade would most likely cause discounts in different sectors and toughen the worldwide shift to sustainability. Our analysis presentations that provide chains throughout all industries produce 60% of worldwide greenhouse gases.

Why have many banks been reluctant to take on their provide chain emissions?

The primary large problem banks come across when looking to carry down their vendor emissions is figuring out the huge choice of companies inside their provide chains. Then, they face the advanced downside of measuring emissions generated via the ones providers.

“If banks cling faulty details about their provide chains, they’re extra uncovered to

With out a true image of all of the firms that perform of their provide chains, banks can be not able to appropriately measure emissions from the ones resources, let by myself get started lowering them. They’d most likely fight to allocate sources successfully and may omit alternatives to higher align their procurement operations with the desires in their providers. Moreover, banks that cling faulty details about their provide chains can be extra uncovered to chance.

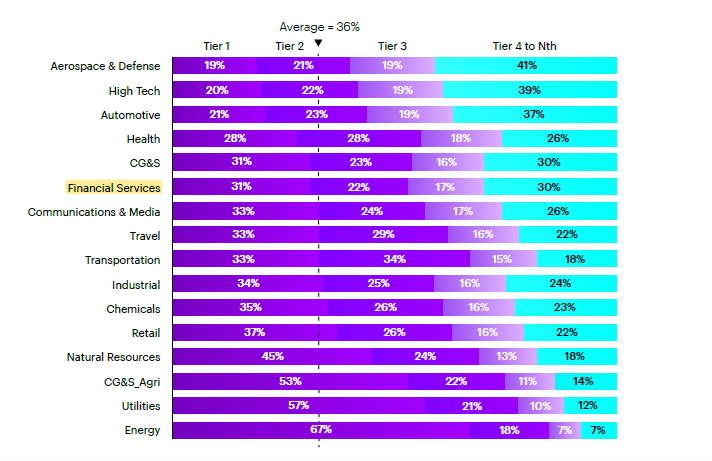

We discovered that little greater than 30% of the emissions generated via the availability chains of monetary products and services companies used to be on account of their direct (tier 1) providers. The remaining used to be produced via subcontractors (tier 2), providers to subcontractors (tier 3) and firms additional down the availability chain (tier 4 – Nth). An astonishing 30% of the emissions generated via monetary products and services provide chains is produced via firms in tier 4 or past.

Banks and different monetary products and services firms want to glance a long way down their provide chains when looking to get a repair on their output of emissions.

Distribution of upstream emissions via tier vendor

Click on/faucet symbol to magnify.

Incessantly the “scorching spots” that generate a large portion of a financial institution’s provide chain emissions are firms which can be well past the establishment’s conventional trade limitations. Every so often they’re in a special nation. To seriously curb their provide chain emissions, banks want to forge nearer ties inside a community of providers that reaches well beyond their speedy product and repair suppliers. With out such relationships, they’ll most likely fight to inspire providers to curtail their emissions.

Greater than 60% of the CEOs we surveyed with the United Countries World Compact file that difficulties in measuring environmental, sustainable and governance (ESG) knowledge throughout their provide chains are a drawback to advancing sustainability of their trade. Whilst 55% of CEOs say their firms have began measuring Scope 3 emissions, best 16% state that such tracking is at an “complex degree”.

The hot talks amongst UK banks about how easiest to curb provide chain emissions have highlighted possible enhancements within the techniques the ones emissions are measured, reported and curtailed. Problems addressed within the discussions come with:

- Aligning a not unusual set of classes for the calculation of provide chain emissions.

- Transferring to supplier-specific calculation methodologies.

- Simplifying the collection and submission of emissions knowledge from providers and contractors.

- Embedding ESG necessities into the banks’ sourcing and contracting actions.

- Incentivising providers to reinforce their sustainability.

- Aligning the sustainability toughen, training and accreditation given to providers.

The suggestions which can be because of emerge from those discussions will equip banks to eventually confront and tame vendor emissions.

You’ll be informed extra in regards to the interbank discussions on provide chain emissions via contacting my colleague, Benjamin Oswin. Our Emerging to the Problem of Web 0 Banking file supplies treasured insights into how banks can boost up their development against changing into sustainable organisations. You’ll additionally touch me. I’m prepared to listen to from you.

Disclaimer: This content material is equipped for normal knowledge functions and isn’t meant for use rather than session with our skilled advisors. This record might check with marks owned via 0.33 events. All such third-party marks are the valuables in their respective house owners. No sponsorship, endorsement or approval of this content material via the house owners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered logos of Accenture.

[ad_2]