[ad_1]

Technical debt is a well known factor within the device global, however it’s turning into increasingly more most sensible of thoughts for banks—in particular banks endeavor a cloud transformation. Deciding what to do about tech debt in most cases comes to an research of the tradeoffs between other approaches.

What’s tech debt?

Tech debt happens when both:

1. Tool merchandise are introduced ahead of they’re totally debugged and do the whole lot they had been meant to do, with the aim of having them into operation temporarily and solving the minor issues later; or

2. Tool turns into out of date and doesn’t paintings neatly with extra complicated techniques, so “fast and grimy” workarounds are applied to keep away from ranging from scratch with a more recent model. Tool that isn’t actively controlled can temporarily accrue this kind of debt.

Evaluating tech debt with monetary debt, you’ll believe the inaccurate or out of date code because the important that must be repaid ultimately. The tech debt is the passion—the rising value of operating round and patching up the previous code—that helps to keep including up as you lengthen the reimbursement. The longer you wait to repay your debt, the extra you find yourself paying in spite of everything.

Banks know that they want to replace their generation incessantly, however as a result of they want to do that with out taking their device offline, this can be a complicated procedure and the prices may also be large. A significant improve prices now not simply cash however group of workers, time and center of attention—all of that are in brief provide in lots of banks. Consequently, they generally tend to get rid of those essential updates for so long as conceivable. Many banks would slightly prioritize the advance of recent merchandise that would generate income temporarily, slightly than spend the money and time to mend the problems inflicting tech debt. Within the interim, they both make do with their previous techniques or patch them up the usage of brief answers.

The price of tech debt

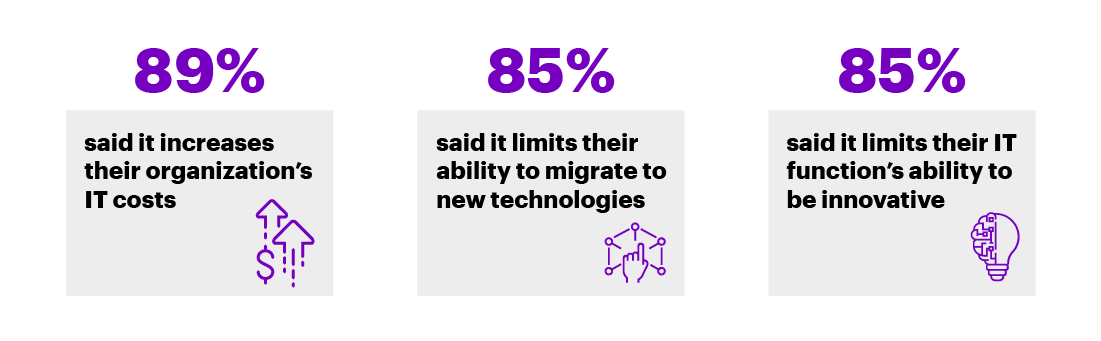

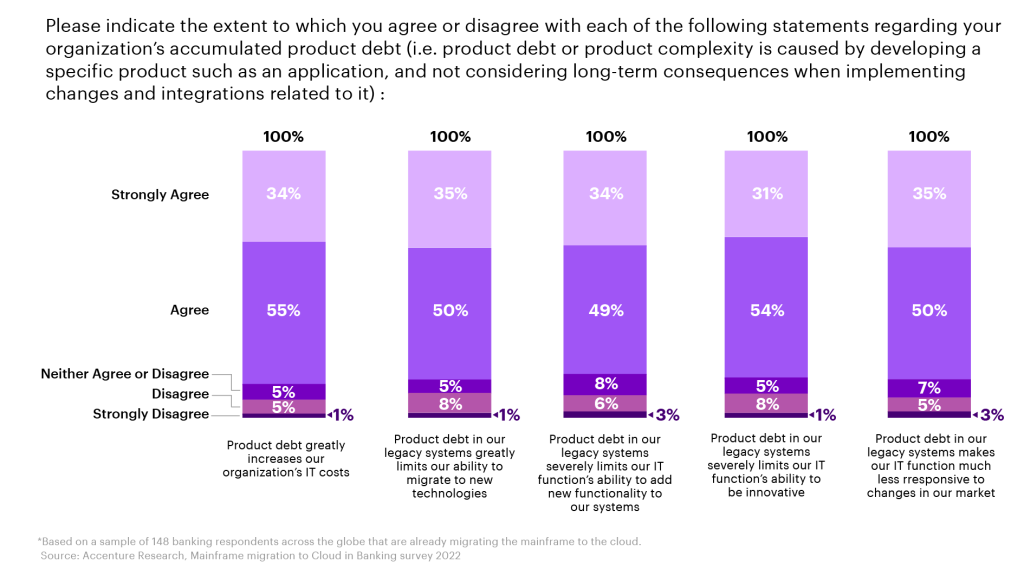

We surveyed 148 banks which are migrating to the cloud, about how product debt / tech debt impacts them.

What occurs when banks collect tech debt?

The longer tech debt is left to amass, the dearer and complex it turns into to proper. Additionally, as tech debt spreads right through more than a few techniques and trade devices, the trade turns into much less aggressive, slower, and extra prone to safety dangers.

One of the major issues than can rise up with tech debt come with:

Inhibited innovation and new product building: Tech debt leaves the financial institution’s builders with out the newest equipment to create state of the art merchandise. It additionally slows the product cycle as a result of legacy code is more likely to create insects and make powerful trying out tougher.

Buyer dissatisfaction: When tech debt impacts customer-facing merchandise like cell banking apps, consumers is also not able to finish their transactions or would possibly to find the app too gradual. Tech debt within the again finish too can reason visitor frustration if it slows the financial institution’s processing of credit score programs and different time-sensitive operations.

Ballooning prices: When the prices of keeping up device don’t seem to be incessantly budgeted for, the result’s a far higher one-time expense when all of this paintings will have to be carried out inside 12 months’s price range, in all probability with nice urgency.

Safety dangers: Banks know that consistent vigilance is needed to stay their knowledge and techniques protected in opposition to cyber assaults. Code this is patched incrementally over the years (or worse—not noted) can go away a financial institution extra prone to assault.

Ability loss: Banks with vital tech debt create a more difficult paintings atmosphere, each inside their DevOps workforce and right through the financial institution. Builders are much less more likely to be drawn to a place of job with out of date and buggy device, as a result of they’ll be spending extra in their time solving issues than operating on thrilling new tasks. In different portions of the financial institution, poorly functioning techniques are more likely to frustrate group of workers and boost up burnout and turnover.

Can banks use AI to struggle tech debt?

“The actual holy grail in banking shall be the usage of generative AI to radically cut back the price of programming whilst dramatically making improvements to the velocity of building, trying out and documenting code.”

– Mike Abbott, Accenture World Head of Banking

Generative AI is shaking up many trade purposes, and device is not any exception. In 2021, GitHub Copilot was once introduced as an AI-assisted software for writing code. Amazon has since adopted go well with with its personal software, CodeWhisperer. The usage of those equipment, some building groups have considerably lowered the time it takes to generate new code through having AI generate the primary draft. In a single GitHub experiment, coders the usage of Copilot finished a programming process round 55% sooner than coders with out Copilot. Whilst systems will nonetheless want to be reviewed, debugged and tweaked to suit the person’s actual necessities, the up-front time financial savings may just cut back the funding had to cope with tech debt and boost up timelines. On the other hand, questions stay about who owns AI-generated code, and about legal responsibility associated with mistakes in it that have an effect on the tip person. Gen AI coding equipment may also be an affordable method to get via a considerable amount of paintings, however as with every new device, the ensuing code must all the time be in moderation reviewed and examined ahead of implementation.

What can banks do about their tech debt?

Many banks are actually dealing with vital ranges of tech debt, that have turn out to be increasingly more obvious as the ones banks orchestrate their plans to transport operations into the cloud. Banks are typically having a look at their choices as a tradeoff between two priorities:

1. Prioritizing modernization through settling their tech debt once conceivable in order that they don’t convey it into their new cloud infrastructure.

2. Prioritizing pace to the cloud through briefly wearing their tech debt into the cloud in order that it doesn’t decelerate their transfer.

Let’s have a look at the advantages and downsides of each and every way.

Prioritizing modernization: advantages

- Tech debt is cleared away totally in order that the financial institution can get started with a blank slate.

- The financial institution positive factors the equipment to be extra cutting edge and get state of the art merchandise to marketplace extra temporarily.

- Banks can construct a greater protection in opposition to safety breaches as a result of legacy device is eradicated.

- Most sensible skill is also drawn to the financial institution as a result of they’ll be operating in a debt-free cloud-first atmosphere that helps extra agility and innovation.

Prioritizing modernization: drawbacks

- Clearing away tech debt can considerably gradual the growth of a cloud migration as a result of extra paintings must be carried out up entrance.

- Modernizing the whole lot immediately will building up the preliminary expense of cloud migration.

- This way would possibly building up the quantity of disruption, or perceived disruption, all over the migration as a result of legacy techniques will disappear. Coaching and up-skilling of group of workers shall be extra vital.

Prioritizing pace: advantages

- The financial institution can understand the worth and price financial savings of cloud extra temporarily.

- Cloud-only programs may also be applied quicker.

- The versatility and scalability of cloud shall be to be had to the financial institution because it tackles tech debt.

- Present group of workers may have extra time to conform and up-skill.

Prioritizing pace: drawbacks

- Tech debt continues to amass for longer, expanding the entire value of addressing it.

- The financial institution would possibly migrate problematic device, equivalent to systems with safety vulnerabilities, into its cloud-based techniques.

- Older device and programs would possibly not paintings as neatly throughout the new cloud framework.

What way must your financial institution take?

There is not any one-size-fits-all method to tech debt. As a substitute, it’s vital to know the tradeoffs and the way they have an effect on the financial institution’s trade targets. Tech debt conversations must be a part of any cloud technique making plans.

We paintings with banks to decide the level and price in their tech debt, which purposes may also be most simply up to date and moved to the cloud, and how one can get to the bottom of their ultimate tech debt so they may be able to meet their targets for cloud migration.

To talk about your financial institution’s tech debt and how one can cope with it all over your cloud migration, touch me. To be informed extra in regards to the many components to believe all over your financial institution’s cloud adventure, make sure to stay studying our newest analysis within the Banking Cloud Altimeter.

Disclaimer: This content material is equipped for basic data functions and isn’t meant for use rather than session with our skilled advisors. This file would possibly confer with marks owned through 0.33 events. All such third-party marks are the valuables in their respective house owners. No sponsorship, endorsement or approval of this content material through the house owners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

[ad_2]