[ad_1]

Smartly over a decade in the past, I used to be lucky sufficient to land a banking management position in industrial and company banking operations. I straight away spotted two issues that experience caught with me ever since.

First, the folk in operations are one of the vital best possible and maximum well-intentioned, albeit frequently overpassed, staff within the company. Once we speak about striking shoppers first, within the again workplace it’s a mantra and a significant supply of motivation for the groups finishing one of the vital extra regimen operational duties crucial to the day by day paintings of the financial institution.

Secondly, lots of the paintings in operations, together with the skill profile, is geared to finishing operational duties outlined inside a transparent coverage and process handbook. Importantly, as lower-complexity paintings used to be computerized and the rest duties turned into extra advanced, operations groups had a harder time successfully finishing the ones duties.

Either one of those issues have best transform extra necessary as automation, now additional reinforced by way of the hot introduction of generative AI, takes on extra advanced paintings, leaving best essentially the most difficult duties for operations staff to finish. This, coupled with the stable lack of abilities because of an growing older team of workers, exposes operations to substantial threat.

So, what will have to a future-ready operations crew seem like? How will operations leaders upskill their staff to regulate a higher-complexity workload? What about the ones staff who can’t take the plunge? Must extra of our destiny operations leaders come from the entrance and center places of work? And the way will operations groups deal with an remarkable stage of alternate control and coaching?

My colleague Colette Prior joins me for this have a look at Business Banking Operations: Tech and skill transformations as a strategic alternative.

As we mentioned in our Business Banking Best Tendencies in 2023 file, the call for for skill is rising as probably the most primary forces shaping the banking trade this 12 months. A scarcity of the higher-complexity abilities had to fill operational roles used to be obtrusive in industrial banks even ahead of the pandemic. Since then, the Nice Resignation and a wave of early retirements have blended to create much more openings. In the meantime, industrial banks proceed to battle to draw younger skill, and with unemployment charges traditionally low, the skill hole may transform a disaster.

In many ways, that disaster has already arrived. Our analysis displays that some industrial banks have skilled attrition charges amongst operations body of workers of greater than 50% over the last two years.

We’ve heard reviews of body of workers shortages and coaching problems inside operations contributing to a upward thrust in transaction mistakes and reporting errors. Inefficiencies within the again workplace run the danger of eroding consider and customer support—irritating for groups and management alike. Personnel demanding situations are even draining the profitability of a few banks. A number of companies are having to influence earnings into dangerous debt reserves to hide imaginable operations missteps.

AI and generative AI will turn into the position of operations

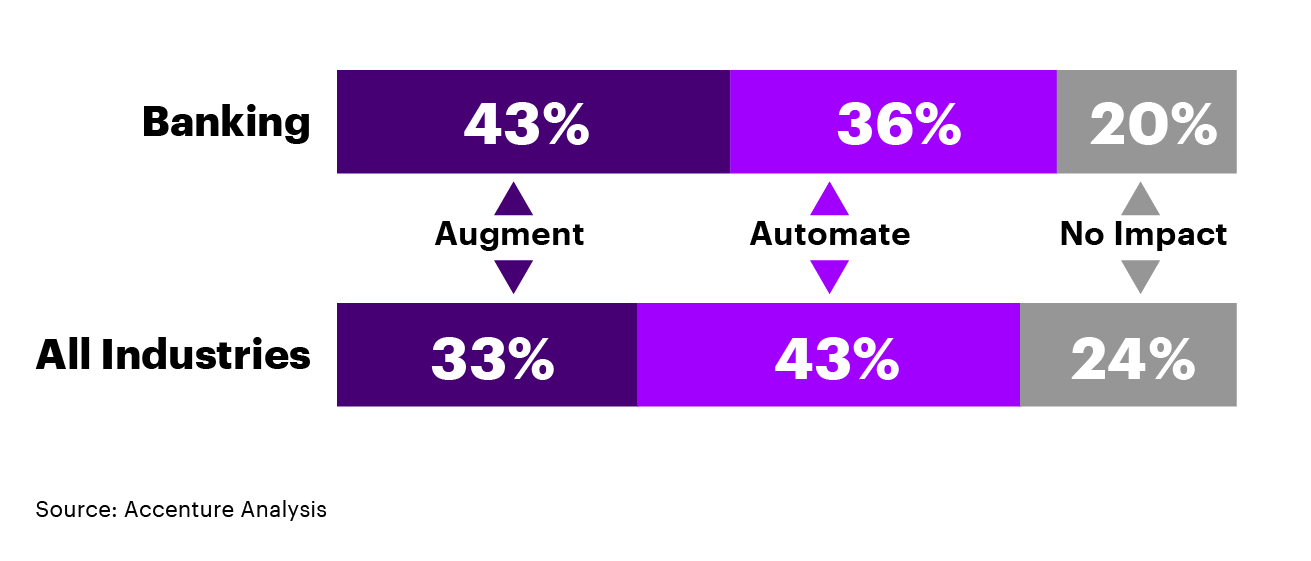

Analysis displays that AI’s affect on banking is predicted to be very vital, with greater than part of staff’ present duties (by way of time spent) appearing excessive doable for automation.

Determine 1. The proportion of US employees’ duties which may be augmented or computerized by way of generative AI.

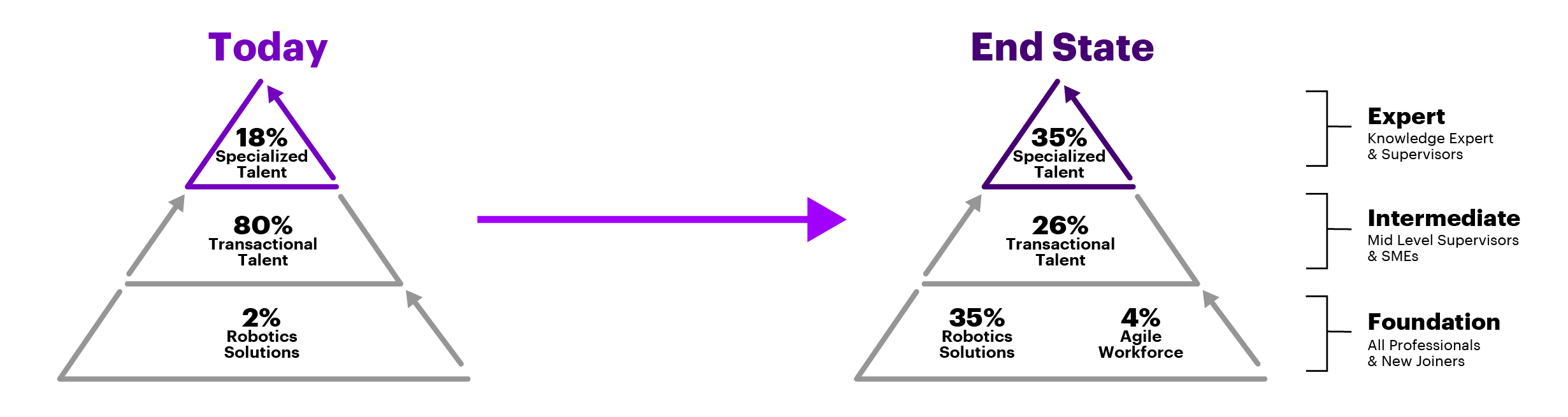

As each AI and generative AI essentially shifts the way in which firms cope with handbook operations, and as lots of our valued staff imagine retirement, banks will desire a planned, complete, and very human skill technique to construct operations groups which can be are compatible to goal. The complete affect on operations of recent automation applied sciences and genAI will most probably spread over the following few years, however the transformation of the operations team of workers will have to get started now. The way forward for operations skill will proceed to shift from tactical to value-add as robot answers permit the automation of transactional actions.

Determine 2. How the composition of the banking operations serve as is prone to alternate.

Some banks are outsourcing all or a part of industrial and company operations to assist simplify the transition.

For instance, one huge US-based financial institution has outsourced the vast majority of its middle- and back-office industrial lending purposes to Accenture. The financial institution’s objectives in doing so had been to scale back prices, and likewise to make the operation future-ready. The financial institution labored with us on the onset to simplify its running fashion and extra centralize essentially the most advanced duties, leaving the ones with the financial institution. Then it partnered with us to power ongoing automation and potency, which we’ve been doing for the previous 5 years.

This has ended in a fashion the place financial institution staff are rewarded with higher-complexity, value-adding roles and each the financial institution and Accenture are collectively in command of riding ongoing automation and potency. When undertaken mindfully and strategically, versatile controlled products and services can assist a financial institution de-risk its attrition drawback and beef up its skill to stay alongside of call for for higher-skilled employees.

For different banks, preserving their mortgage operations is the smarter play.

For those banks, we advise a three-part skill technique:

1. Take a recent strategy to having access to skill from inside and outdoor the group. To draw and stay expert body of workers, banks will have to bolster the paintings surroundings and occupation alternatives they provide new hires. Align recruitment and construction with the group’s long-term human capital necessities. And don’t disregard about reskilling your present team of workers, together with groups from outdoor operations. Glance to the center and entrance places of work to fortify operations skill. By means of bringing in middle-office staff, or even combining industrial and company middle-office and back-office operations, banks can create the synergy and versatility had to pivot to a smaller but extra expert operational team of workers. Bringing front- and middle-office skill—in any respect ranges—into operations drives shared duty for results, improves the figuring out of processes around the broader group, builds power for quicker transformation and will increase occupation trail choices.

2. Follow clever generation to assist handle your other people. Computerized processing methods relieve operations body of workers of repetitive duties and loose them to have interaction in additional advanced, high-value actions that offer larger paintings delight. It’s essential that employees obtain ongoing coaching to stay tempo with upgrades and advances in those methods. Middleware packages incorporating AI can fortify conversation and collaboration throughout groups and accelerate workflows. Importantly, operations groups will have to be organising data-driven automation factories staffed with professionals who perceive the equipment to be had and the original processes inside the operation.

3. Enlarge employees’ functions and abilities thru retraining and occupation construction. Make stronger morale, build up worker delight and scale back churn with coaching alternatives. Empower back-office employees to increase their abilities and supply significant alternatives to use their functions in different spaces of the industry. Complete succession making plans will assist nurture and retain skill and offset the consequences of the present wave of retirement.

Banks that retain their mortgage operations will have the benefit of dedicating substantial sources and management oversight to the transformation in their mortgage operations team of workers.

The rewards for banks that put in force this three-part technique can also be considerable. Banks with tough and environment friendly operations, staffed by way of expert and motivated employees who’re supported by way of complicated applied sciences, will beef up customer support, fortify profitability and curtail their publicity to threat.

Without reference to the method banks take, something is sure: operations would require a smaller and better-skilled skill pool at some point. It’ll be laborious, and also you will have to be truthful, and also you will have to carry your crew together with you. Making plans for this now—and in an excessively human method—is very important to main the group thru its transformation adventure.

In case you’d like to discuss your financial institution’s operations skill technique, please touch both folks: Jared or Collette.

To be informed extra in regards to the developments we think to form our trade, learn our Business Banking Best Tendencies in 2023.

[ad_2]